A decade in markets teaches you one brutal truth

Wealth isn’t built by how much you invest — it’s built by how consistently you stay invested.

Let me start with a scene I’ve watched repeat itself for over ten years.

A young professional sits across from me — tea getting cold, phone buzzing — and says:

“Sir, ₹5,000 SIP se kya hi hoga? I’ll start once my income increases.”

Every time I hear this, I see a future version of that person — ten years older — wishing they had begun exactly now.

Because here’s the uncomfortable reality most blogs don’t tell you:

₹5,000 SIP is not small.

Starting late is.

And this article exists because most people ask the wrong question.

They ask:

“Which fund gives highest return?”

The right question is:

“Which fund can quietly, reliably, survive 15–20 years of my life?”

That’s what we’re going to answer — honestly, without hype, and from real market experience.

Why this topic matters right now (and why most people get it wrong)

Over the last few years, I’ve seen two dangerous trends among new investors:

- Obsession with recent 1-year returns

- Blind copying of social media SIP screenshots

What’s missing is context.

Markets today are:

- Volatile

- News-driven

- Emotionally exhausting for beginners

If you’re investing ₹5,000 every month, you don’t need excitement.

You need survivability.

The fund you choose should:

- Protect you from your own impatience

- Grow even when you stop tracking markets

- Let compounding do the heavy lifting

This article is different because it doesn’t sell dreams.

It shows what actually works when life gets messy.

First, a hard-earned truth about ₹5,000 SIP

Let me say this clearly, based on years of portfolio reviews:

Your SIP amount matters far less than your fund behavior during bad years.

I’ve seen:

- ₹25,000 SIP investors panic and exit

- ₹3,000 SIP investors stay calm and outperform

Why?

Because good funds don’t just grow money.

They control investor emotions.

And that’s exactly how we’ll evaluate fund categories — not by hype, but by behavior.

Understanding the real job of a ₹5,000 SIP

A ₹5,000 SIP is usually:

- A first serious investment

- A long-term habit builder

- A learning phase before bigger capital

So the fund’s job is not to:

- Make you rich in 3 years

- Beat every index every year

Its real job is to:

- Stay invested through crashes

- Compound quietly

- Prepare you for larger decisions later

Once you understand this, fund selection becomes much clearer.

The 4 fund categories people usually consider (and what I’ve learned about each)

Let’s walk through them the way a seasoned investor would — calmly, with scars included.

Large Cap Mutual Funds – Stability over excitement

Large-cap funds invest in market leaders — companies that already dominate their industries.

What I’ve personally observed:

- They fall less during crashes

- They recover slower than mid/small caps

- They reward patience, not timing

For a ₹5,000 SIP beginner, large caps:

- Reduce anxiety

- Encourage consistency

- Build discipline

But they have a limitation — moderate returns.

When large-cap funds make sense:

- First-time investors

- Low risk tolerance

- People who panic easily during corrections

Flexi Cap Funds – The most underrated SIP choice

If I had to name one category I’ve seen quietly outperform over full cycles, it’s Flexi Cap funds.

Why?

Because:

- They are not forced into market-cap boxes

- Fund managers shift between large, mid, small caps

- They adapt to changing cycles

In real life, good flexi-cap funds:

- Protect capital in bad times

- Capture upside in rallies

- Reduce timing mistakes by investors

For a ₹5,000 SIP, flexibility is power.

Mid Cap Funds – Growth with emotional turbulence

Mid-cap funds are where compounding gets exciting — and dangerous.

From experience:

- Returns can be excellent over 10–15 years

- Volatility tests investor patience brutally

- Poor fund choice can destroy confidence

I’ve seen investors stop SIPs exactly when mid-caps needed time.

Mid-caps suit:

- Long-term thinkers

- Emotionally stable investors

- SIPs that won’t be touched for 7+ years

Small Cap Funds – High risk, high responsibility

Let’s be honest — small caps are not for everyone.

Yes, returns can be stunning.

But drawdowns can be savage.

For ₹5,000 SIP investors:

- Small caps should be limited exposure

- Only via disciplined SIPs

- Only with strong stomach

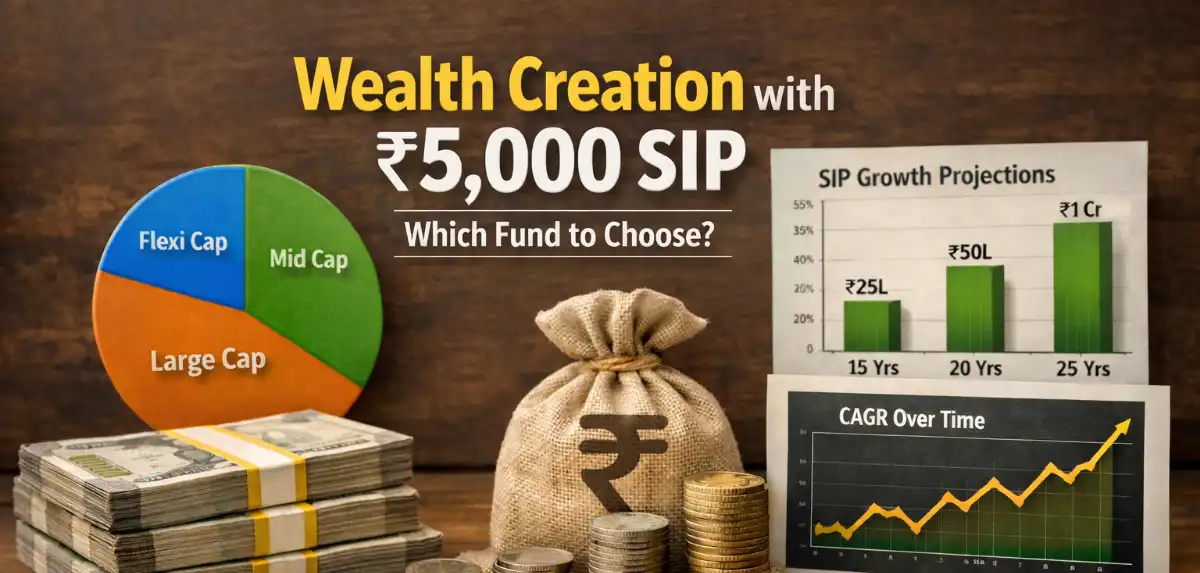

Table 1: How ₹5,000 SIP behaves across fund categories (Realistic long-term view)

| Fund Category | Avg CAGR (15 yrs) | Volatility | Ideal Holding | Suitability |

|---|---|---|---|---|

| Large Cap | 11–12% | Low | 10–15 yrs | Beginners |

| Flexi Cap | 12–14% | Medium | 10–15 yrs | Most investors |

| Mid Cap | 14–16% | High | 12–18 yrs | Patient investors |

| Small Cap | 16–18% | Very High | 15+ yrs | High risk takers |

These are long-cycle averages, not best-year returns.

So… which fund should YOU choose for ₹5,000 SIP?

After years of watching real portfolios — not just charts — my answer is rarely extreme.

The most sensible structure I recommend:

- ₹3,000 – Flexi Cap Fund

- ₹2,000 – Mid Cap Fund

Why this works:

- Flexi cap provides stability and adaptability

- Mid cap adds growth engine

- Emotional balance improves SIP longevity

This combination survives:

- Bear markets

- News panic

- Investor boredom

And that matters more than chasing the “best fund”.

Table 2: ₹5,000 SIP – 15, 20 & 25 year wealth projection (Conservative logic)

| Duration | Total Invested | Expected Value (13% CAGR) |

|---|---|---|

| 15 Years | ₹9,00,000 | ~₹23–25 Lakhs |

| 20 Years | ₹12,00,000 | ~₹45–50 Lakhs |

| 25 Years | ₹15,00,000 | ~₹85 Lakhs–₹1 Cr |

No fantasy numbers.

No cherry-picked periods.

Just patient compounding.

What most people don’t factor in (but should)

SIP step-up is the silent hero

Even a 5–10% annual SIP increase changes everything.

Behavior beats fund selection

Staying invested during:

- 2020 crashes

- 2022 corrections

- Sideways years

…is where wealth is created.

Review frequency matters

Annual review is enough.

Monthly checking kills discipline.

Table 3: Impact of SIP step-up on ₹5,000 investment

| Scenario | SIP Pattern | Wealth after 25 yrs |

|---|---|---|

| Flat SIP | ₹5,000 fixed | ~₹90 Lakhs |

| 5% Step-up | Gradual increase | ~₹1.25 Cr |

| 10% Step-up | Income-aligned | ~₹1.7 Cr |

Same discipline. Different mindset.

Common mistakes I’ve seen ₹5,000 SIP investors make

- Chasing last year’s best fund

- Stopping SIP during market falls

- Switching funds too often

- Ignoring expense ratio and consistency

Remember:

A mediocre fund held long beats a great fund held briefly.

FAQs – Real questions investors actually ask

Is ₹5,000 SIP enough to create wealth?

Yes — if started early, stepped up gradually, and stayed invested for 15–25 years.

Should I invest only in equity with ₹5,000?

For long-term goals (10+ years), equity makes sense. For shorter goals, mix with debt.

Can I start with one fund only?

Absolutely. A good flexi-cap fund alone is enough initially.

When should I change funds?

Only if:

- Fund strategy changes

- Long-term underperformance (5+ years)

- Your own risk profile changes

What if markets crash?

That’s when SIP works best. The worst time emotionally is often the best time financially.

Final thoughts — from someone who’s seen both regret and reward

Every wealthy investor I know has one thing in common:

They started before they felt ready.

₹5,000 SIP won’t change your life in one year.

But it can change the direction of your next 25.

Don’t wait for:

- Perfect income

- Perfect market

- Perfect fund

Start with:

- A sensible fund

- A calm plan

- A long view

Your next step (do this today):

- Choose one good flexi-cap fund

- Start the SIP

- Set an annual reminder to increase it

That’s how real wealth is built — quietly, patiently, and intentionally.

If you want, I can next help you:

- Pick specific fund names

- Design a step-up SIP plan

- Create a ₹5,000 → ₹1 crore roadmap

Just say the word.