1. Introduction: Breaking the Time-for-Money Trap

Most people spend their lives in the “Active Income” cycle, which means trading your limited hours for a paycheck. If you stop working, the money stops coming. The purpose of this guide is to introduce you to a different path: Passive Income, where your money works for you.

Table of Contents

Think of building wealth like planting an apple tree. You spend significant time and effort upfront—digging the hole, watering the sapling, and protecting it from the elements. Initially, you see no fruit at all. But eventually, the tree grows strong enough to produce fruit every season without you needing to plant it again. Building wealth is “front-loaded” work: you invest your resources today to build an “engine” that generates cash for the rest of your life.

Passive Income: Doing the heavy lifting once and getting paid for it repeatedly, even while you sleep. It breaks the link between your time and your earnings.

The engine that makes this possible is a mathematical marvel known as compounding.

2. The Engine of Growth: The Power of Compounding

Compounding isn’t just interest; it is returns earning further returns. When you reinvest your earnings, your principal base grows larger. In the next period, you earn interest on that new, larger base.

In the world of finance, we distinguish between periodic compounding (where interest is added at fixed intervals like once a year) and continuous compounding. While periodic compounding is common, continuous compounding represents the theoretical maximum where interest is reinvested at every possible moment. Think of this as the difference between a snowball and an avalanche—the frequency of compounding is the gravity that pulls it down the mountain.

Comparing Compounding Frequency Example: ₹1 Lakh invested at 12% for one year

| Compounding Type | Calculation Method | Final Amount after 1 Year |

| Annual Compounding | Added once at year-end | ₹1,12,000 |

| Continuous Compounding | Reinvested every moment | ₹1,12,749 |

The “Aha!” Moment: While a difference of ₹749 seems small over one year, when applied over decades, more frequent compounding becomes your most powerful ally in reaching your goals faster.

3. Visualizing Your Journey: The Rule of 72 and the 7-3-2 Breakthrough

To help you stay the course, I want to give you two mental shortcuts to visualize your progress.

The Rule of 72 This is a quick way to estimate how long it takes for your money to double. Simply divide 72 by your annual return rate.

- Example: If you earn a 10% return, your money will double in approximately 7.2 years (72 / 10 = 7.2).

- Mentor’s Note: Keep in mind this is an approximation; market volatility means it won’t be accurate to the day, but it’s a brilliant “napkin math” tool for long-term planning.

The 7-3-2 Rule Wealth building is a marathon, not a sprint. This rule illustrates how the journey to your first three milestones (the “Crores”) accelerates exponentially:

- The First 7 Years (The Grind): It may take you 7 years of disciplined investing to reach your First Crore. Growth feels slow because your base is small. This is where most people quit.

- The Next 3 Years (The Acceleration): Because you are now earning returns on that first crore, it only takes 3 more years to reach your Second Crore.

- The Final 2 Years (The Explosion): Your base is now so large that compounding does the heavy lifting. You can reach your Third Crore in just 2 more years.

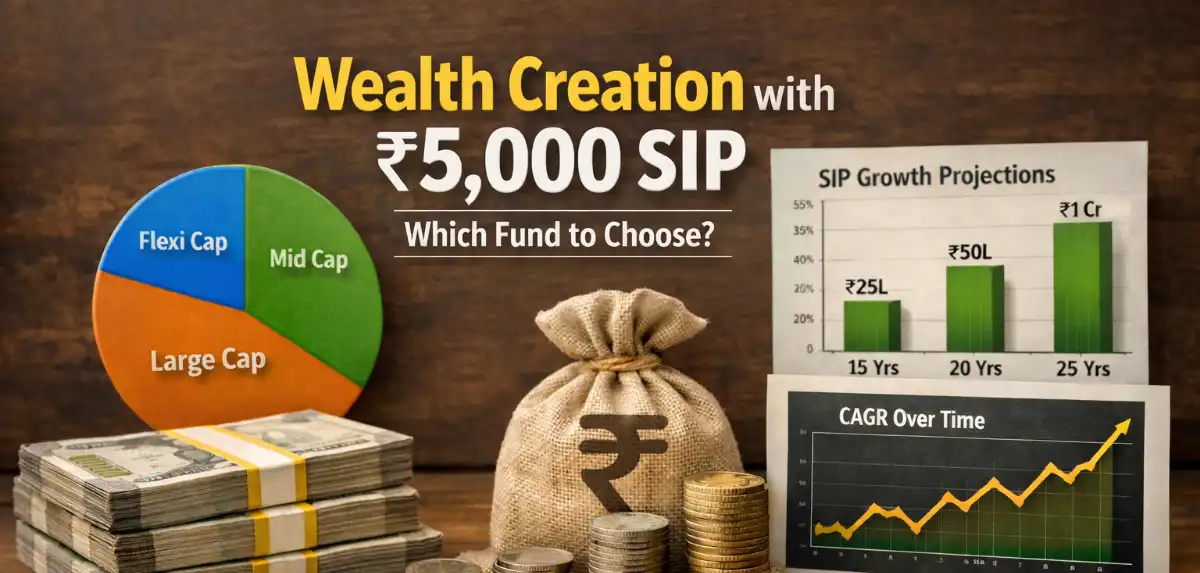

4. The Systematic Investment Plan (SIP): Turning Discipline into Wealth

You don’t need a fortune to start. A Systematic Investment Plan (SIP) is a smart, hassle-free mode of investing small sums regularly. It automates the habit of building wealth so you don’t have to think about it.

The Impact of Time on a ₹5,000 Monthly SIP Assumed Annualized Return: 18%

| Feature | Scenario A (5 Years) | Scenario B (10 Years) | Scenario C (15 Years) |

| Total Investment | ₹3,00,000 | ₹6,00,000 | ₹9,00,000 |

| Assumed Return | 18% | 18% | 18% |

| Final Corpus | ₹4.93 Lakh | ₹16.86 Lakh | ₹46.01 Lakh |

Mentor’s Note on Reality: While 18% is a fantastic illustrative scenario, real market returns vary. For context, the S&P 500 has a historical average annual return of approximately 10.56%. Whether the return is 10% or 18%, the lesson remains: the longer the time, the more “magic” the engine produces.

5. The Shield: Overcoming Volatility with Rupee Cost Averaging

Many beginners fear the market because it goes up and down. However, for an SIP investor, a falling market is actually a gift. This is thanks to Rupee Cost Averaging (RCA).

SIP Investor vs. Lump-Sum Investor (9-Month Volatile Market)

| Month | Unit Price | SIP Investment (₹1,000/mo) | SIP Units Bought | Lump-Sum (₹9,000 at Start) | Lump-Sum Units |

| 1 | ₹50 | ₹1,000 | 20 | ₹9,000 | 180 |

| 4 | ₹44 | ₹1,000 | 23 | – | – |

| 9 | ₹52 | ₹1,000 | 19 | – | – |

| Total | ₹9,000 | 188 Units | ₹9,000 | 180 Units |

The “Aha!” Moment: Both investors spent ₹9,000. However, the SIP investor ended up with 8 more units and a lower average cost (₹48) because their plan automatically “bought the dip.” Volatility is not your enemy; it is your tool for buying assets at a discount.

6. The “Golden Rule”: Why Starting Today is Your Most Profitable Decision

The most expensive mistake you can make is waiting. The “Cost of Delay” is the literal fortune you lose by not letting compounding start its work.

Comparison Box: The ₹5.5 Crore Delay

- Investor A (Age 25): Invests ₹10,000/month until age 60.

- Total Investment: ₹42 Lakhs.

- Final Wealth: ₹6.5 Crores.

- Investor B (Age 40): Invests ₹10,000/month until age 60.

- Total Investment: ₹24 Lakhs.

- Final Wealth: ₹99.9 Lakhs.

The Lesson: Even though Investor B invested more than half of what Investor A did, their final wealth is roughly 6 times smaller. Starting 15 years later cost Investor B over ₹5.5 Crores in potential wealth.

7. Reality Check: Managing Risks and Inflation

To succeed, you must defend your wealth against the two silent “eroders”:

- Inflation: This erodes your purchasing power. If your expenses are ₹30,000 today, you will need approximately ₹80,000 in 20 years just to maintain the exact same lifestyle. Your goal is to ensure your returns outpace this growth.

- Market Volatility: In the short term, the market is a rollercoaster. But historical data proves that “time in the market” beats “timing the market.”

3 Risks Beginners Fear & The Mentor’s Fix

- Volatility: The Fix: Use Rupee Cost Averaging via SIPs to lower your average cost automatically.

- Market Timing: The Fix: Invest for the long term (7+ years) where market cycles have historically smoothed out.

- Liquidity (Needing Cash Fast): The Fix: Maintain an emergency fund equal to at least six months of expenses in a safe account so you never have to sell your long-term investments during a temporary market dip.

8. Conclusion: Your Roadmap to the First Crore

Building wealth is not a matter of luck or complex schemes; it is a result of matching your skills to a plan and remaining patient. During the early years, you must treat your portfolio like a Cricket match. There will be long “Cricket periods” where growth is slow and you are simply “digging in” to defend your wicket. Be patient. The explosive “sixes and fours” of compounding only arrive for those who stay on the field.

Checklist for Success:

- Choose Your Path: Select your investment vehicles (SIPs, Mutual Funds, or Digital Gold).

- Set Your Goal: Define what you are building for (Retirement, Education, or a Home).

- Automate Your Savings: Use tools to automate your daily, weekly, or monthly contributions to remove the temptation to spend.

- Remain Disciplined: Do not be discouraged by “The Grind.” The most significant growth always happens in the final stages.

The secret to financial freedom is simple: start small, start today, and let time do the heavy lifting for you.

1 thought on “The Wealth Accelerator: A Beginner’s Guide to Financial Freedom”