Are small investments the secret to a wealthier future? We often think big, bold moves lead to success. But what about the power of smaller, more manageable investments?

Exploring small investments, we see they can grow over time, leading to big wealth. But is this dream possible, or just a myth?

We’ll look into the real deal about small investments making you rich. We’ll see what it takes to reach financial success this way.

Key Takeaways

- Understanding the potential of small investments

- How small investments can add up over time

- The importance of patience in investing

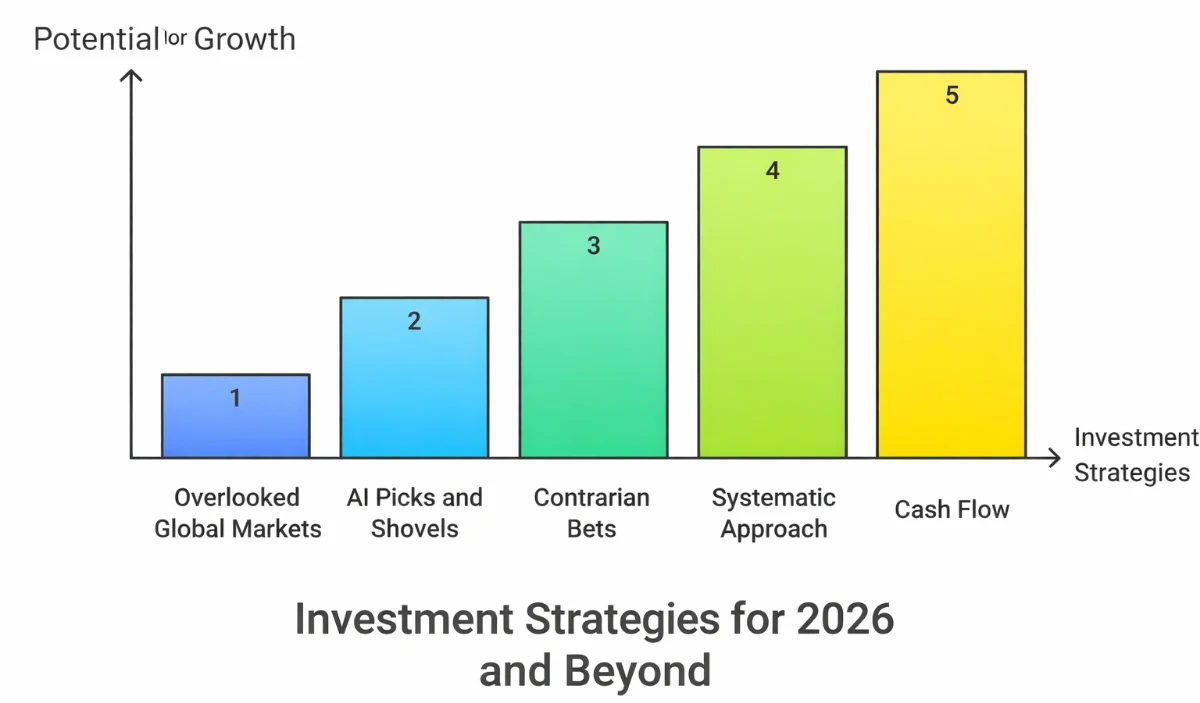

- Strategies for maximizing returns on small investments

- The role of risk management in investment decisions

The Myth vs. Reality of Building Wealth Through Small Investments

Building wealth through small investments is often misunderstood. It’s time to clear up the confusion. Many believe you need a lot of money to make a big return. But, this isn’t always true.

The truth is about understanding what a “small investment” really means. It’s also about the power of being consistent.

What Constitutes a “Small Investment” in Today’s Economy

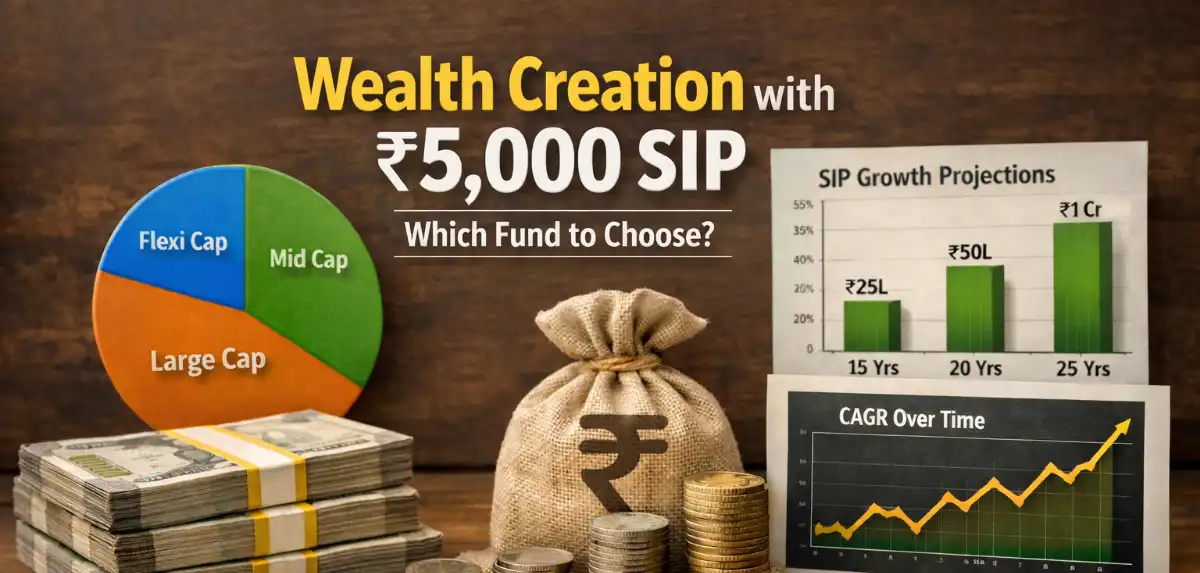

In today’s world, a “small investment” can be as little as ₹1,000 to ₹5,000 a month. This is something many people can afford. You can put this money into things like mutual funds, stocks, or systematic investment plans (SIPs).

| Investment Type | Minimum Investment | Potential Return |

|---|---|---|

| SIP in Mutual Funds | ₹1,000 | 8-12% per annum |

| Stocks | ₹1,000 | Varies |

| Public Provident Fund (PPF) | ₹500 | 7.1% per annum |

The Power of Consistency Over Size

Consistency is crucial when it comes to small investments. Putting in a set amount regularly can build up a lot of wealth over time. It’s not about how much you invest, but how often you do it.

For example, investing ₹5,000 every month for 10 years can grow into a big amount. The important thing is to start early and keep going.

Can You Become Rich With Small Investments? Realistic Truth

Many of us dream of getting rich with small investments. The key is understanding wealth building and the role of small investments. We must explore what it means to be “rich,” the math behind investment growth, and setting realistic goals.

Defining “Rich” in the Indian Context

In India, being “rich” means financial security and a comfortable lifestyle. It’s not just about money; it’s about meeting needs and enjoying luxuries. For many, being rich means owning a home, giving quality education to kids, and enjoying financial peace.

The Mathematical Reality of Investment Growth

Let’s look at how a small investment grows over time. With an 8% annual return, ₹10,000 a month can grow a lot. Here’s a simple example:

| Years | Total Investment | Estimated Returns | Total Value |

|---|---|---|---|

| 5 | ₹6,00,000 | ₹1,03,515 | ₹7,03,515 |

| 10 | ₹12,00,000 | ₹4,65,398 | ₹16,65,398 |

| 15 | ₹18,00,000 | ₹11,41,191 | ₹29,41,191 |

Setting Reasonable Expectations

While growth is possible, setting realistic expectations is key. Returns can change with market conditions, and there are risks. So, diversify your portfolio and think long-term to handle market ups and downs.

The Compound Interest Effect: Your Greatest Ally

Building wealth is easier with the compound interest effect. This tool boosts our investment strategy, leading to big financial gains over time. Understanding compound interest is key to reaching our financial goals.

How Compound Interest Works for Small Investors

Compound interest adds interest to both the principal and any interest already earned. This means the interest in future periods is based on a higher balance. For small investors, this can make even small starts grow big over time. The key is to start early and be consistent, letting compounding work for us.

Real-Life Examples of Compound Growth in India

In India, many investors have seen the power of compound interest. For example, investments in Public Provident Fund (PPF) or certain mutual funds have grown a lot. An investor who started a Systematic Investment Plan (SIP) in a mutual fund early in their career saw huge growth over two decades.

This growth helped the investor achieve big goals like buying a home or funding their children’s education. By using compound interest, small investors in India can build a big wealth over time. It shows the power of a good investment strategy and patience in financial planning.

Time Horizon: The Critical Factor for Small Investors

The time horizon is key to success in small investments. It’s important to know how long we plan to invest. A good plan helps us handle market ups and downs and make smart choices.

Short-Term vs. Long-Term Investment Strategies

Investors often choose between short-term and long-term plans. Short-term strategies aim for quick gains, usually in a year or less. On the other hand, long-term strategies keep investments for years, hoping for bigger growth. An expert says,

“Patience is the key to successful investing. Those who can’t resist the temptation to buy and sell based on short-term market fluctuations often miss out on substantial long-term gains.”

Long-term plans are better for small investors. They let returns grow over time. This method also reduces risks from market changes and timing issues.

Setting Realistic Timeframes for Wealth Building

Choosing a realistic timeframe is crucial for growing wealth through small investments. It’s important to match our investment goals with a suitable time frame. For example, saving for retirement or a big goal might need 10 to 20 years or more. Being realistic about our time horizon helps us avoid quick money schemes and stay focused on our long-term goals.

To succeed financially, we must think about our goals, how much risk we can take, and the current market. These factors help us pick the right time horizon for our investments.

5 Small Investment Options with Potential in India

In India, there are many promising investment paths. Finding the right fit is key to growing your wealth. It’s about matching your investment with your financial goals and how much risk you can take.

Systematic Investment Plans (SIPs) in Mutual Funds

SIPs let you invest a set amount regularly in mutual funds. This method helps you invest wisely and steadily. It also helps you manage market ups and downs over time.

Benefits of SIPs:

- Flexibility in investment amount and frequency

- Rupee cost averaging

- Compounding benefits

Public Provident Fund (PPF) and Government Schemes

PPF is a long-term investment with government backing. It offers tax benefits and is considered safe. Other government schemes like NSC and KVP also offer good returns.

Key Features:

- Tax deductions under Section 80C

- Interest compounded annually

- Lock-in period of 15 years

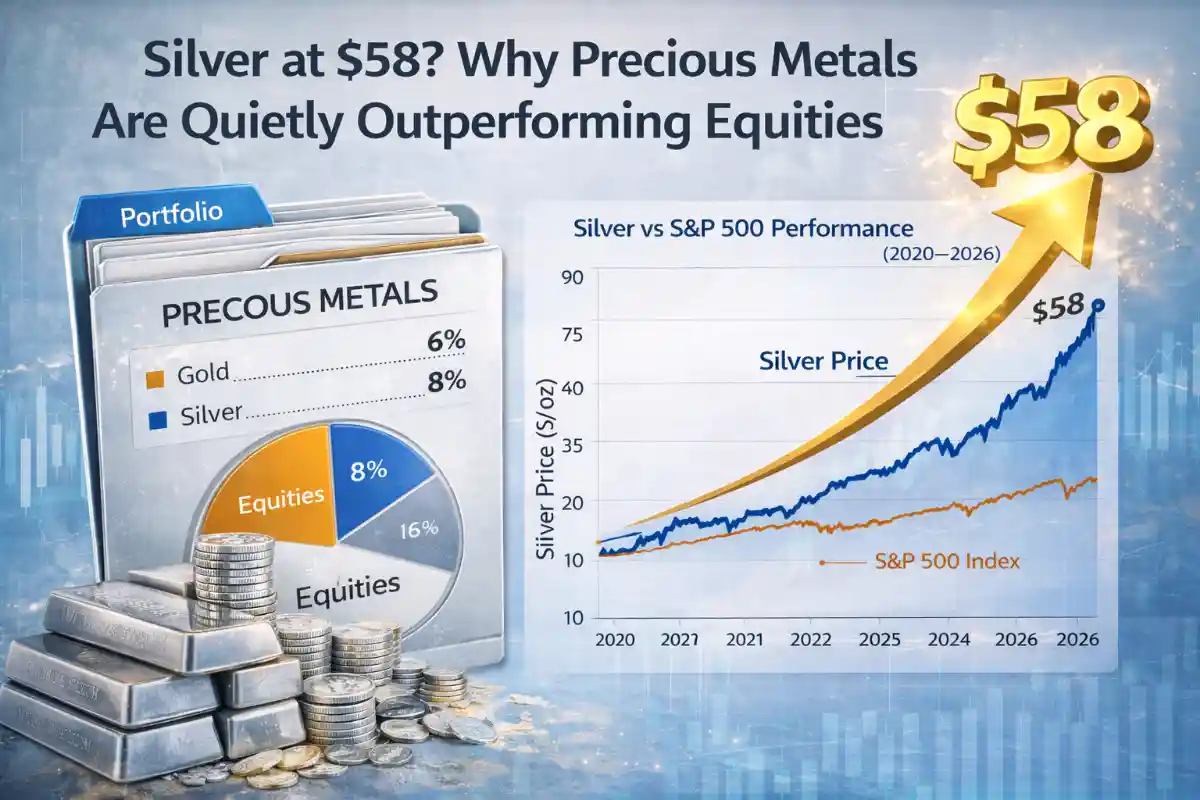

Digital Gold and Sovereign Gold Bonds

Digital gold and Sovereign Gold Bonds (SGBs) are great against inflation. They let you enjoy gold’s value without the hassle of physical storage.

Advantages include:

- No storage costs or risk of theft

- Backed by the government (in the case of SGBs)

- Potential for long-term appreciation in value

Small-Cap Stocks and Index Funds

Small-cap stocks might offer high growth but come with more risk. Index funds, however, spread out your investment. They track a market index, which can lower risk.

Considerations:

- Higher risk associated with small-cap stocks

- Diversification benefits of index funds

- Long-term growth potential

Exploring these small investment options can help Indian investors make smart choices. It’s crucial to pick based on your financial goals and how much risk you’re willing to take.

The Role of Risk Management in Growing Small Investments

Risk management is key to success in small investments. We must navigate many investment options carefully. This way, we can protect our money and get the best returns.

Diversification Strategies for Limited Capital

Diversification helps manage risk. By investing in different areas, we spread out our risk. For those with less money, this might mean investing in mutual funds, bonds, and small stocks.

Here’s a simple diversification strategy:

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Mutual Funds | Medium | 8-12% |

| Government Bonds | Low | 5-7% |

| Small-Cap Stocks | High | 15-20% |

When to Take Calculated Risks vs. Playing It Safe

It’s important to know when to take risks and when to be cautious. Younger investors can usually handle more risk because they have time to recover. Those close to retirement often choose safer options to protect their savings.

Calculated risks mean investing in things that could grow a lot but might also lose value. Playing it safe means choosing investments that are less risky but might not grow as much.

Common Pitfalls That Prevent Small Investors from Building Wealth

Many small investors face challenges in growing their wealth. Small investments can lead to big gains, but mistakes can block this path. It’s key for investors to know these pitfalls to succeed in building wealth.

Emotional Decision-Making and Panic Selling

Emotional choices are a big problem for small investors. Panic selling in bad market times can cause losses and missed chances. Investors should plan for the long term and stay true to their strategy, not react to short-term changes.

Lack of Research and Due Diligence

Not doing enough research is another big issue. Small investors often jump into things without knowing the risks. Doing deep research helps make smart choices and avoid problems.

Chasing Quick Returns and Market Timing

Going for fast profits and trying to predict market moves is very risky. Small investors should aim for steady growth, not quick wins. A steady investment plan can help deal with market ups and downs.

To dodge these traps, small investors should stick to a solid plan, stay informed, and avoid acting on emotions. Important steps include:

- Creating a long-term investment plan

- Doing thorough research before investing

- Steering clear of trying to time the market

The Psychology of Wealth Building with Limited Resources

Reaching financial freedom is about more than just money. It’s also about mindset. When resources are limited, the mental hurdles can be as big as the financial ones. It’s key to understand and beat these hurdles to build wealth.

Overcoming the “Not Enough to Invest” Mindset

Many feel they can’t invest because they don’t have enough money. But this thinking can block wealth growth. Investing isn’t about how much you have; it’s about starting. Small, regular investments can grow over time.

Warren Buffett said, “Do not save what is left after spending, but spend what is left after saving.” To beat the “not enough” mindset, focus on the habit of investing, not the amount. Use systematic investment plans (SIPs) to automate investments. Learning about different investments and their returns is also crucial.

| Investment Habit | Benefit |

|---|---|

| Automating Investments | Reduces the impact of emotional decision-making |

| Starting Small | Encourages consistency and patience |

| Educating Oneself | Enhances understanding of investment options |

Developing Patience and Long-Term Thinking

Patience is key in wealth building. Investments grow over time, and expecting quick wins can lead to frustration. A long-term view helps investors stay calm during market ups and downs.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

Thinking long-term allows for compounding, where earnings grow further. It’s vital to have realistic goals and see wealth building as a long journey, not a quick race.

The Impact of Inflation and Taxes on Small Investment Growth

When we think about small investments, it’s key to know how inflation and taxes affect growth. As small investors, we must see how these factors can cut down our returns over time.

Understanding Real Returns After Inflation in India

Inflation can lessen the buying power of our money over time. For example, with an average annual inflation rate of 4-5% in India, our investments’ real value can drop a lot if returns aren’t adjusted for inflation.

| Year | Nominal Return | Inflation Rate | Real Return |

|---|---|---|---|

| 1 | 8% | 4% | 4% |

| 2 | 8% | 5% | 3% |

| 3 | 8% | 4% | 4% |

The table shows that even with a steady nominal return of 8%, real returns change with inflation. This shows why we must think about inflation when judging investment success.

Tax-Efficient Investment Strategies for Indian Investors

Taxes also play a big role in our investment returns. In India, smart tax-efficient strategies can cut down tax bills. For instance, investing in tax-free bonds or using tax-advantaged accounts like the Public Provident Fund (PPF) can be good choices.

“Tax planning is a key part of investment planning. By picking the right investment tools, Indian investors can lower their tax burden and boost their returns.”

By grasping the effects of inflation and taxes, we can make better investment choices. This can help us grow our wealth over time.

Building Multiple Income Streams: Beyond Traditional Investments

Financial freedom often comes from having different income sources. Modern finance is complex, and relying on one income is risky. Diversifying our income can reduce risks and improve our financial health.

Side Hustles and Passive Income Opportunities in India

In India, there are many ways to earn extra money. Side hustles like freelancing, online tutoring, or selling handmade items can add to your income. Also, passive income opportunities like stocks, REITs, or digital products can earn money without much work. These options can greatly improve your financial stability.

Reinvesting Returns to Accelerate Growth

Reinvesting your earnings can really boost your finances. By using your income to invest, you can grow your money faster. This method not only increases your returns but also helps you reach long-term goals like retirement or buying a home. It’s crucial to have a solid investment plan to make reinvesting work for you.

Real Stories: Indians Who Built Wealth Starting Small

Many Indians have reached financial freedom with small, steady investments. Their stories show that building wealth is possible. They inspire others to begin their investment journey, no matter how small.

Case Study: From Monthly SIPs to Financial Freedom

An individual started investing ₹5,000 monthly in a mutual fund SIP. Over 15 years, with steady returns, this investment grew a lot. It helped the person achieve financial freedom.

“The power of SIPs lies in their ability to compound returns over time,” a financial advisor says. “It shows that small, consistent investments can lead to big wealth.”

Lessons from Successful Small Investors

Successful small investors share key traits. They are patient, consistent, and have a well-diversified portfolio. An investor said, “

The key is not in the amount you invest, but in the consistency and the time you give your money to grow.

” These lessons are very helpful for anyone wanting to build wealth.

By learning and using these principles, many Indians can follow the path to financial success through small investments.

Conclusion: The Realistic Path from Small Investments to Financial Success

We’ve looked into how small investments can lead to wealth. We’ve cleared up myths and found the real way to financial success. The main point is that small investments, done regularly and with knowledge, can bring big financial wins over time.

Investing wisely means knowing about compound interest, managing risks, and avoiding mistakes. By thinking long-term and using smart tax strategies, Indian investors can get the most out of their money.

Stories of people who made it big with small investments show its power. It’s not about how much you invest, but how often and patiently you do it.

By sticking to these principles, we can follow the path to financial success from small investments. This will help us build a more secure financial future.

FAQ

Can small investments really make you rich?

Yes, small investments can add up over time. They can generate significant wealth through compound interest and consistent investing.

What constitutes a “small investment”?

A small investment is any amount that’s easy for an individual to handle. It could be ₹1,000 to ₹5,000 per month, based on their financial situation.

How does compound interest work for small investors?

Compound interest works by earning interest on both the principal and any interest already earned. This leads to exponential growth over time.

What are some small investment options available in India?

In India, popular small investment options include Systematic Investment Plans (SIPs) in mutual funds. Other options are Public Provident Fund (PPF), digital gold, and small-cap stocks.

How can I manage risk while investing small amounts?

To manage risk, diversify your investments across different asset classes. This includes equity, debt, and gold. Also, keep a long-term perspective.

What are the common pitfalls that prevent small investors from building wealth?

Common pitfalls include making emotional decisions and not doing enough research. Chasing quick returns can also lead to impulsive decisions, harming investment growth.

How can I overcome the “not enough to invest” mindset?

Start with a manageable amount. Focus on building a consistent investment habit. Don’t worry too much about the amount.

What is the impact of inflation on small investment growth?

Inflation can reduce the value of your investments. It’s important to look at returns adjusted for inflation when evaluating investment performance.

How can I build multiple income streams beyond traditional investments?

Explore side hustles and passive income opportunities. This could be renting out a spare room on Airbnb or investing in peer-to-peer lending.

What are some tax-efficient investment strategies for Indian investors?

Tax-efficient strategies include investing in tax-saving instruments like Equity-Linked Savings Schemes (ELSS). Also, use tax deductions available under Section 80C of the Income Tax Act.