1. Introduction: The Silent Protector in a Volatile World

In a world of quantitative easing and fiscal dominance, gold is no longer a mere investment; it is a sovereign insurance policy. Over my 15 years in the Indian capital markets, I have seen cycles of exuberance and despair, yet gold remains the ultimate hedge against the systemic “unseen” risks.

Most participants misunderstand Gold ETFs, treating them as short-term speculative trades. This perspective ignores the strategic necessity of transitioning from bulky, illiquid physical gold to high-velocity digital equivalents. For the modern high-net-worth portfolio, liquidity is the only true form of security.

The SBI Gold ETF (SETFGOLD) serves as a sophisticated tool for purchasing power parity. It bridges the gap between the ancient trust in bullion and the efficiency of a digital exchange. Below, we examine the specific mechanics that make this fund a cornerstone for your 2030 wealth vision.

2. The Architecture of SETFGOLD: More Than Just Digital Paper

When you allocate capital to SETFGOLD, you are participating in an open-ended exchange-traded scheme backed by physical gold of 99.5% fineness. The trust here is tangible, not theoretical. This isn’t just paper; it is a direct claim on a vault.

The fund is managed by Vandna Soni, who brings over 12 years of experience to the portfolio. This human element of management trust is vital for ensuring the replication method remains tight. The core identity of the fund is defined by these technical vitals:

- NSE Symbol: SETFGOLD

- ISIN: INF200K01099

- Bloomberg Code: SETFGOLD IN EQUITY

- Allocation: 98.55% Precious Metals, 1.45% Cash/Equivalents.

The “So What?” Factor: A senior strategist looks at that 1.45% cash sleeve and sees “Impact Cost” protection. This small liquidity buffer ensures that the fund can manage daily operational expenses without forced selling of physical bullion, thereby protecting the NAV from unnecessary friction.

3. Performance Analytics: Decoding the 86% Growth Phenomenon

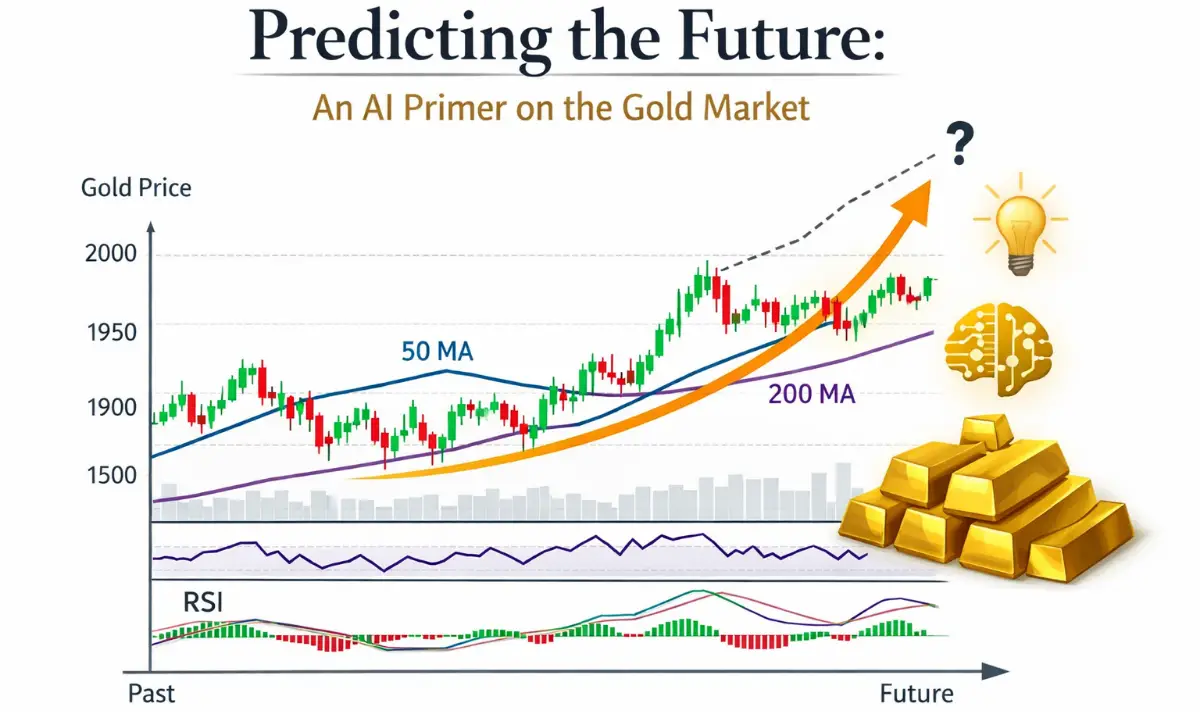

The trajectory of gold between 2024 and early 2026 has been explosive. To prevent confusion, we must distinguish between our foundational anchor data and the live market context. While 2025 established the trend, early 2026 has witnessed a massive volatility-driven breakout.

Historical Multi-Year Performance (Anchored August 2025)

| Period | SBI Gold ETF Returns (%) | Benchmark (Gold LBMA) (%) | BSE Sensex TRI (%) |

| 1 Year | 40.46% | 42.21% | -1.95% |

| 3 Years | 24.40% | 25.70% | 11.65% |

| 5 Years | 13.31% | 14.26% | 17.05% |

| Since Inception | 11.61% | 12.66% | 12.68% |

Real-Time Momentum (Contextual February 2026)

By February 4, 2026, the 1-year trailing return surged to 86.04%. This spike reflects global economic anxieties. However, the real “Manager’s Grade” is the Tracking Error of 0.2066% (for the 1-year period ending August 2025).

The “So What?” Factor: For an HNW investor, a low tracking error is the difference between a reliable hedge and a leaky bucket. Despite a Tracking Difference of -1.7462% (the inevitable cost of management), SETFGOLD remains a surgically precise proxy for the underlying metal.

4. Peer Benchmarking: The “Creamy Layer” Comparison

In the Indian landscape, liquidity is the primary differentiator. If you cannot exit a position of ₹50 Crores without moving the market price, the instrument has failed you. SETFGOLD consistently occupies the “creamy layer,” where average daily traded value remains high.

| Metric | SBI Gold ETF | Nippon India Gold BeES | ICICI Pru Gold ETF | Tata Gold ETF |

| AUM (Feb 2026) | ₹17,400.51 Cr | High | High | High |

| Expense Ratio | 0.70% (Statutory) | 0.80% | 0.50% | 0.40% |

| 1Y Return | 86.04% | 84.93% | 86.04% | 84.81% |

| Liquidity | High | High | High | High |

The “So What?” Factor: Observe the AUM growth. In August 2025, SBI managed ₹9,505.83 Crores. By February 2026, it reached ₹17,400.51 Crores. This massive influx signifies institutional trust. While the statutory TER is 0.70%, realized efficiency often brings this down to 0.64%, showcasing operational excellence.

5. The Cost of Ownership and the 2026 Tax Reality

Frictional costs can break a long-term strategy. The 2024 Union Budget significantly upgraded the attractiveness of Gold ETFs by reducing the holding period for Long-Term Capital Gains (LTCG) to just 12 months. This standardization removes the “tax-drag” that once hampered digital gold.

2026 Taxation Rules for Gold ETFs

| Aspect | Rule |

| Short-Term (STCG) | Held < 12 Months: Taxed at individual Income Tax Slab Rate. |

| Long-Term (LTCG) | Held > 12 Months: Taxed at 12.5% flat. |

| Indexation | No indexation benefits applicable. |

The “So What?” Factor: Previously, investors were locked in for 36 months to qualify for long-term status. The shift to a 12-month period transforms SETFGOLD into a high-velocity strategic asset. You can now rebalance your portfolio annually with a much lower tax hurdle than physical gold or debt funds of the past.

6. Forward-Looking Forecast: Price Targets (2026–2030)

Gold rarely moves in a straight line, but its upward trajectory is supported by structural drivers: central bank reserve accumulation and persistent inflationary pressures. These targets are trend-based assumptions reflecting gold’s role as the ultimate wealth preserver.

Expert Analysis: Projected Price Targets (2026–2030)

- 2026: ₹135

- 2027: ₹170

- 2028: ₹195

- 2029: ₹230

- 2030: ₹270

The “So What?” Factor: The ₹270 target by 2030 represents more than just a price; it represents the preservation of your purchasing power against likely rupee depreciation over the decade. This is a moderate outlook designed for those seeking portfolio equilibrium rather than speculative gambling.

7. Operations & Accessibility: The Mechanics of Creation Units

To understand liquidity, one must understand the “Creation Unit”—a fixed basket of 115,000 units. Market Makers interact with the fund at this scale to ensure retail investors can trade single units on the NSE effortlessly.

- Large Investors: Minimum ₹25 Crores for direct interaction with the Mutual Fund.

- Retail Investors: Minimum of 1 unit tradeable on the exchange.

- Risk Profile: Standard Deviation of 12.11%.

The “So What?” Factor: The “High Risk” rating on the Riskometer refers purely to Price Volatility Risk, not credit risk. The physical gold is there; the price simply fluctuates. This volatility necessitates a capital appreciation mindset rather than a short-term exit plan.

8. Real-World Doubts, Clarified

How is the NAV calculated? The NAV is a function of the closing price of physical gold minus recurring expenses (like the 0.70% TER). It is declared every business day by 11:00 PM.

Does this ETF pay dividends? No. SETFGOLD is a Growth option fund. Any appreciation in gold is reflected in the NAV, which is more tax-efficient for the investor.

What is the physical safety of the gold? The gold is held by SBI-SG Global Securities Services with Brinks India as the sub-custodian. It is fully insured and vaulted, eliminating “locker risk.”

Can I redeem for physical gold? Only Market Makers or Large Investors dealing in Creation Unit sizes (115,000 units) can redeem for physical bars. Retail investors redeem via the exchange for cash.

9. Conclusion: Forging a Resilient Future

The core thesis of this deep dive is simple: SBI Gold ETF is a sophisticated tool for portfolio equilibrium. It allows you to participate in the “safe haven” trade with the surgical precision of an institutional strategist.

I encourage you to stop viewing gold as an “ornament” and start viewing it as a strategic asset. It is the missing piece of your legacy, designed to preserve your hard-earned capital against the erosion of time.

Reflect on your current asset allocation. If gold isn’t a deliberate part of your 2030 vision, it is time to consult your financial advisor. SETFGOLD might just be the resilience your portfolio requires.