1. The “Invisible Thief” of Wealth

Imagine you place a ₹100 note in a sealed jar today. A year later, you take it out. It is still the same piece of paper, and the number “100” is still printed on it. However, when you go to the bakery, you find that the loaf of bread that cost ₹100 last year now costs ₹107. Your money looks the same, but its ability to buy things has been “stolen.”

Table of Contents

This is the work of inflation. At its simplest, inflation is the rise in the general price level of goods and services over time. It is the fundamental challenge of personal finance because it quietly erodes the “purchasing power” of your hard-earned wealth.

Key Concept: Inflation Inflation is the rate at which the value of a currency falls, causing the prices of goods and services to rise. If your money doesn’t grow faster than the inflation rate, you are effectively losing wealth even if your bank balance is increasing.

The Good News: While the “thief” is silent, you have an equally quiet and powerful antidote: Compounding. When you start early and choose the right tools, your money can grow at a pace that doesn’t just keep up with rising prices but leaves them in the dust.

To see this in action, we must look past the numbers on your statement and understand the difference between “Nominal” and “Real” growth.

2. Nominal vs. Real Returns: The Math of Truth

When you evaluate an investment, you usually see the “Nominal Return”—the percentage increase in the actual number of rupees you have. But as a smart investor, you must focus on the “Real Return.” This is the math of truth; it is what remains after you subtract the inflation rate.

| Scenario | Nominal Return | Inflation Rate | Real Return (Actual Growth) |

| Nominal Growth | 9% | 0% | 9% |

| Inflation-Adjusted | 9% | 6% | 3% |

The “So What?” for Investors: Ignoring this math leads to a significant “shortfall in post-retirement years.” If your money grows at 9% while inflation is at 6%, your actual purchasing power only increases by 3%. To maximize this growth, keep in mind that monthly compounding (common in SIPs) multiplies wealth significantly faster than annual compounding over long periods.

While a 9% return sounds positive, let’s explore why the “safest” places to keep money might actually be the most dangerous.

3. The Traditional Savings Trap: Redefining Safety

It is perfectly natural to want your money to feel “safe.” For generations, Indian families have relied on Savings Accounts and Fixed Deposits (FDs) because they offer psychological comfort—you know exactly what the number on the screen will be tomorrow.

However, we need to redefine what safety actually looks like. If an FD yields 6.5% but inflation is touching 7%, you are experiencing a Negative Real Return. You have more rupees, but they buy fewer groceries than they did a year ago.

Why do we stay in these losing “safe” instruments?

- Safety Perception: The comfort of a guaranteed principal amount.

- Cultural Habits: A long-standing tradition of relying on fixed-income products.

- Limited Advisory: A lack of access to professional advice that explains the erosion caused by inflation.

True safety isn’t just about preserving the number of rupees you have; it’s about preserving what those rupees can buy. Over decades, this erosion can turn a retirement fortune into a mere fraction of its intended value.

4. The ₹1 Crore Illusion: Visualizing Erosion

Many people aim for ₹1 Crore as their “magic number” for retirement. However, in today’s economy, that goal is often a mirage. Financial experts warn that for those living in metro cities, a realistic target should actually be ₹4–5 Crore.

To understand why, look at how the value of ₹1 Crore shrinks over a 20-year horizon:

| Time Horizon | Purchasing Power (Real Value) | Monthly Income “Feel” |

| Today (Age 60) | ₹1 Crore | ₹33,000 |

| 10 Years Later | ₹53 Lakhs | ₹17,500 |

| 20 Years Later (2045) | ₹23 Lakhs | < ₹16,000 |

If traditional savings can’t protect us from this shrinkage, we need a more dynamic strategy to fight back and reach that higher ₹4–5 Crore goal.

5. Building an Inflation-Proof Strategy

Winning the battle against inflation requires moving beyond traditional jars and into market-linked growth.

- Market-Linked Assets (SIPs): Equities historically grow faster than traditional options over the long term.

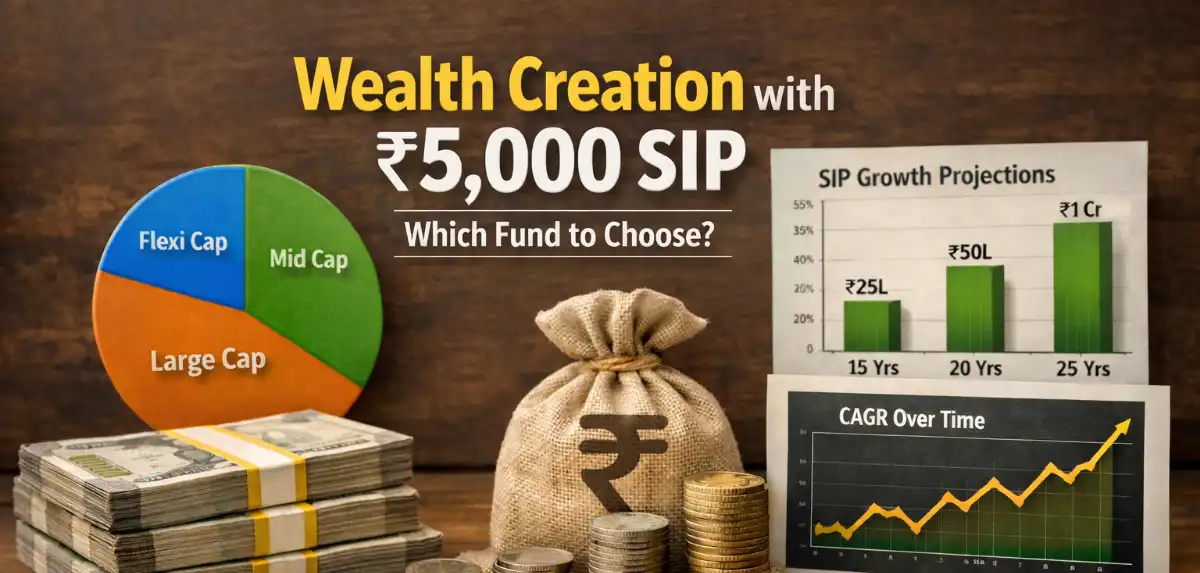

- The 15-Year Milestone: A monthly SIP of ₹10,000 can grow to approximately ₹50 Lakh.

- The 25-Year Power: That same ₹10,000, given 25 years of discipline, can grow to a staggering ₹1.6 Crore.

- The “Step-Up” SIP: This is your most powerful weapon. By increasing your SIP contribution by just 10% every year as your income grows, you can close the gap between the “₹1 Crore Illusion” and the ₹4–5 Crore reality. For example, stepping up a ₹10,000 SIP by 10% annually over 15 years can result in a corpus of ₹82 Lakh—an additional ₹32 Lakh compared to a fixed SIP.

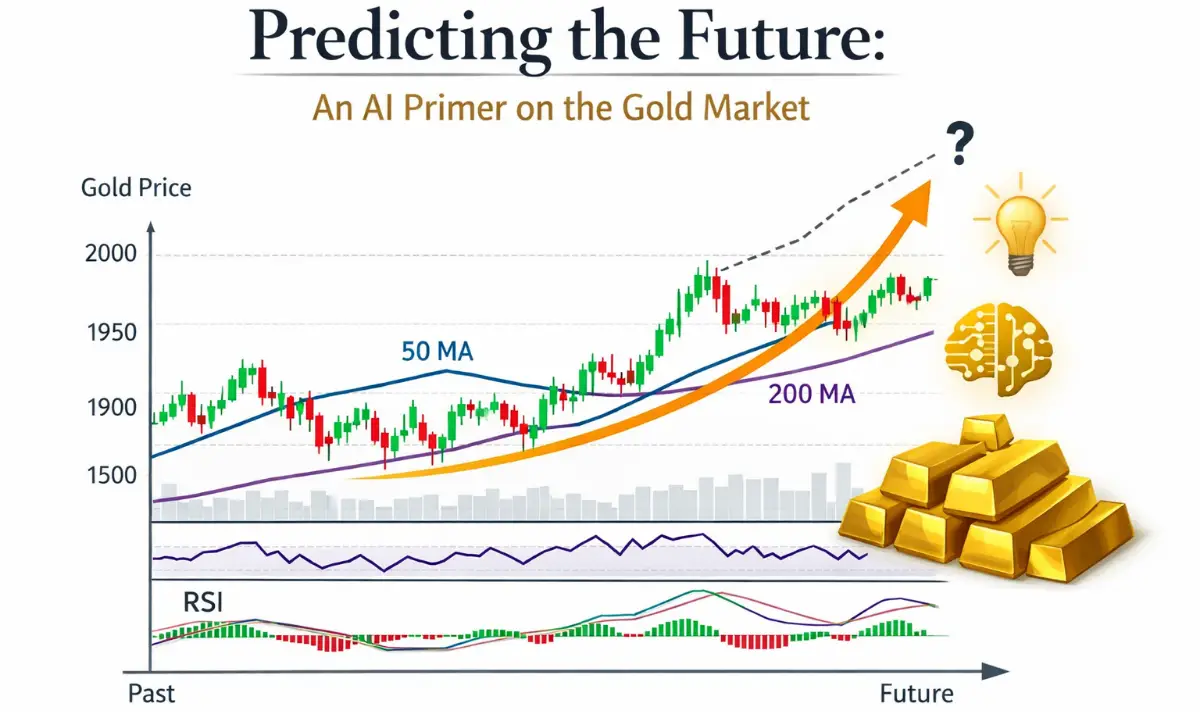

- Diversified Hedges: Tangible protections like Gold remain a trusted hedge for 68% of investors. Tools like Sovereign Gold Bonds (SGBs) allow you to benefit from gold’s value while earning additional interest.

6. The Final Lesson: Time and Empowerment

The most valuable element in your growth is not just the money you invest, but the time you give it to compound.

Consider Rohan vs. Meera:

- Rohan starts at age 30, investing ₹10,000 a month for 25 years.

- Meera starts at age 40, investing the same ₹10,000 a month for 15 years.

Because Rohan started just 10 years earlier, his money has significantly more time to compound, creating a much larger safety net against inflation. Starting early doesn’t just mean more money; it means less pressure to save aggressively later in life.

Take the Lead: Research shows that 78% of people are aware that inflation threatens their future, yet only 25% of Indians take active steps to plan for it. By reading this guide and taking the actions below, you are already moving into that top 25% of proactive investors.

Learner’s Action Plan

- [ ] Track Real Returns: Always subtract the inflation rate (currently approx. 6%) from your investment returns to see your actual progress.

- [ ] Start Your SIP Today: Don’t wait for a “better time.” Even a small start leverages the power of time.

- [ ] Automate a Step-Up: Set your SIP to increase by 5% or 10% annually to match your salary hikes and beat inflation’s curve.

- [ ] Diversify Your “Safe” Money: Move a portion of your long-term savings from low-yield FDs into market-linked instruments to ensure your purchasing power grows.