1. From Pipe Dream to Digital Reality

For the average Indian professional, the Dubai skyline has long been a symbol of an unattainable financial tier. There is a profound emotional disconnect between a monthly salary in Rupees and the multi-crore barrier of a luxury villa in Downtown Dubai.

In my practice as a CFP, I often see this skepticism manifest as a fear of “scams.” Investors assume that if an entry point sounds too low, it must be a Ponzi scheme. However, the reality has shifted from physical acquisition to strategic asset allocation.

Table of Contents

The “₹500 gateway” is the result of the democratization of high-yield assets. Through Fractional Ownership and REITs, we have moved into an era of “Trust Tech.” This allows for the tactical diversification necessary in a volatile global economy.

Geographical diversification is no longer just a “good idea”; it is a sovereign risk hedge. By spreading capital across jurisdictions, you insulate your portfolio from localized currency depreciation and domestic market volatility.

2. The Dubai Macro-Thesis: 17 Quarters of Momentum

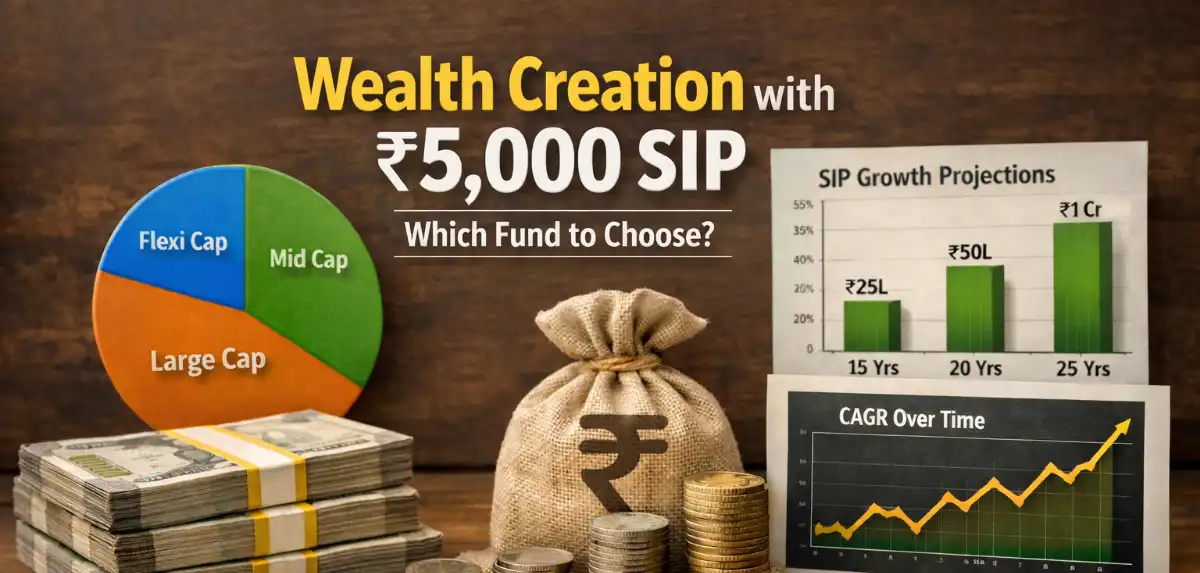

Market momentum is a far more reliable indicator of long-term success than individual property hype. As of late 2024, Dubai has recorded 17 consecutive quarters of growth, a trend confirmed by Bloomberg’s November 2024 analysis.

This sustained climb has created a significant “Supply-Demand Gap.” As property prices outpace individual affordability, we see yield compression in full-unit ownership but remarkable yield resilience in fractional models.

While the high-net-worth market faces entry friction, fractional platforms allow mid-market investors to chase high yields in premium areas like JVC or Business Bay. You are essentially buying into a systemic momentum that outpaces traditional Indian hubs.

Real Estate Comparison: India vs. Dubai

| Metric | India (Mumbai/Delhi) | Dubai Real Estate |

| Average Rental Yield | 2% – 3% | 6.9% (Source: June 2025 Data) |

| Income Tax on Rent | Applicable Slab Rate | 0% |

| Capital Gains Tax | 12.5% – 20% (Approx) | 0% |

| Occupancy Rates | Variable (70-85%) | 95% (Record High) |

| Currency Stability | Rupee Volatility | Dirham-USD Peg (High) |

3. The Triple-Engine Profit Model: Beyond Simple Rent

In my observation, many investors fail to calculate their Weighted Average Cost of Capital (WACC) impact correctly. They focus on “rent” while ignoring the “Triple-Engine” effect that Dubai offers to Indian residents.

The first engine is the high rental yield (6-10%). The second is capital appreciation (3-5%). But the third, and most critical for Indians, is the currency hedge. Because the Dirham is pegged to the USD, you gain 3-4% annually just from Rupee depreciation.

This acts as a natural shield for your wealth. Over a 5-year horizon, the cumulative impact of earning in a “hard currency” while enjoying tax-free gains in the source country creates a massive delta compared to domestic-only portfolios.

4. Mechanism A: Fractional Ownership Platforms (Stake & SmartCrowd)

The evolution of real estate “Trust Tech” has replaced the need for a physical flight and a multi-crore cheque. Platforms like Stake and SmartCrowd use Special Purpose Vehicle (SPV) structures to protect retail capital.

When you invest, the SPV—a legal entity in the Dubai International Financial Centre (DIFC)—becomes the owner. You become a legal shareholder in that SPV. You receive a Title Deed from the Dubai Land Department (DLD) as proof of ownership.

Stake, launched in 2021, has already funded over 200 properties with a total value exceeding 556 million Dirhams (over ₹1250 crore). This scale provides the institutional-grade due diligence that individual investors usually lack.

Conservative investors should favor the “Hold Strategy” for steady 6-12% yields. Aggressive portfolios may lean toward the “Flip Strategy,” which targets 15-20% returns through the renovation and quick resale of undervalued units.

Fractional Platform Deep-Dive

| Feature | Stake (Launched 2021) | SmartCrowd (Launched 2017) |

| Minimum Entry | 500 AED (~₹12,000) | 500 AED (~₹12,000) |

| Portfolio Value | 556M+ AED (₹1250cr+) | 140+ Properties |

| Proven Track Record | 200+ Properties | 50M+ AED Gross Profit Paid |

| Analysis Model | MIT Analysis Model | Robust Financial Screening |

| Fee Structure | 1.5% Entry / 0.5% Admin | 1.5% Entry / 0.5% Admin |

5. The ₹500 Entry via Listed REITs

While fractional platforms require roughly ₹12,000, Real Estate Investment Trusts (REITs) are the true “₹500 gateway.” Listed on the Nasdaq Dubai and DFM, these operate with the liquidity of a stock and the backing of physical assets.

The “90% Dividend Rule” ensures that these trusts distribute the vast majority of their rental income to you. This is the most efficient way to achieve portfolio volatility reduction without large capital outlays.

For the price of a coffee, you can own a piece of a diversified portfolio. As a CFP, I find this the most mathematically sound way for beginners to “test the pipes” of international investing with zero friction.

Dubai REIT Comparison (2025-2030 Projections)

| REIT Name | Exchange | Price (INR Equivalent) | Div. Yield | Occupancy |

| ENBD REIT | Nasdaq Dubai | ₹45 ($0.485 USD) | 8.33% | 95% |

| Emirates REIT | Nasdaq Dubai | ₹65 ($0.69 USD) | ~5.00% | High |

| Dubai Residential | DFM | ₹30 (1.24 AED) | 3.39% | New (2024) |

6. The Regulatory Shield: LRS, DFSA, and the “20% TCS” Myth

To avoid “Ponzi” traps, your capital must sit under the Dubai Financial Services Authority (DFSA). This independent regulator enforces international anti-money laundering standards and ensures transparency in asset management.

Indian investors operate under the Liberalized Remittance Scheme (LRS), allowing up to $250,000 in annual transfers. There is a common myth that the 20% Tax Collected at Source (TCS) is a “cost” that destroys returns.

Crucially, the 20% TCS only applies to remittances exceeding ₹7 Lakhs in a financial year. For the “₹500 investor,” this is a non-issue. For larger investors, it is merely an advance tax you claim back during your ITR filing.

7. The 2025 Frontier: Real Estate Tokenization

We are currently witnessing the intersection of blockchain and bricks. The Dubai Land Department’s 2025 Tokenization project recorded a staggering $399 million in transactions in May 2025 alone.

This accounted for 17.4% of all real estate deals that month. We’ve seen platforms like Tripo tokenize a 1.75 million Dirham villa and sell it in under five minutes, signaling a massive shift in market liquidity.

However, from a CFP perspective, this is a “Watch but Wait” space. Many platforms are still in the VARRA licensing phase. Stick to regulated fractional platforms or REITs for your core capital until the regulatory dust fully settles.

8. The Expert’s Action Plan: A Step-by-Step Implementation

Analysis paralysis is the primary reason most investors fail to build global wealth. To move from a viewer to an owner, you must follow a tactical roadmap that minimizes initial risk while testing the system.

- Digital Onboarding: Download Stake or SmartCrowd. Complete your KYC with Indian documents in 15 minutes.

- Property Browsing: Use the MIT Analysis model to evaluate JVC or Business Bay properties. Look for a 3-5 year holding target.

- LRS Compliance: For amounts under ₹7 Lakhs, the process is seamless. For more, ensure your bank uses the “Immovable Property” purpose code.

- Portfolio Monitoring: Watch the dividends hit your wallet. Reinvest them to benefit from compounding in a tax-free jurisdiction.

9. Frequently Asked Questions

Is it legal for Indians to invest via LRS? Yes. The RBI permits Indian residents to invest in overseas immovable property and securities under the LRS limits ($250k/year).

What happens if a platform like Stake shuts down? Your investment is in an independent SPV. You hold the share certificate, and the DLD records the Title Deed. The asset remains yours regardless of the platform’s status.

How do I exit and get my money back? Fractional platforms offer 6-month exit windows or secondary markets. REITs offer the best liquidity, as they can be sold instantly on the Nasdaq Dubai exchange.

Is there any tax on my earnings in Dubai? Dubai maintains a 0% tax environment for individual rental income and capital gains. You only need to account for tax in India based on your global income status.

10. Conclusion:

The transition from a “local landlord” to a “global asset owner” is a vital psychological shift. As Dubai cements its role as a global financial hub toward 2030, the 17 quarters of momentum are likely just the baseline.

The high occupancy rates (95%) and tax-free environment offer a “tax-shield” that domestic markets simply cannot match. Whether you start with ₹45 in a REIT or ₹12,000 in a fractional villa, the key is to begin.

Don’t let the scale of the skyscrapers intimidate you. Download the apps to browse, consult your CA regarding LRS limits, and stop being a spectator. The gateway is open; it is time to diversify.