1. Market Architecture: Structural Dissonance and Operational Realities

The transition from localized, time-bound equity markets to borderless, 24/7 digital exchanges represents a fundamental shift in capital mobility and liquidity management. For the modern portfolio, this transition replaces the rigid, sovereign-governed schedules of legacy finance with a global, “always-on” environment. While the Indian stock market operates within a specific geography and timeframe, the crypto ecosystem functions as a decentralized, global liquidity pool, requiring a complete recalibration of how wealth managers approach market access and trade execution.

Table of Contents

Operational Comparison: Indian Equities vs. Virtual Digital Assets (VDAs)

| Feature | Indian Stock Market (NSE/BSE) | Crypto Ecosystem (Global/Local) |

| Market Hours | 9:15 AM – 3:30 PM (Closed Weekends/Holidays) | 24/7/365 |

| Reporting Authority | SEBI (Securities & Exchange Board of India) | FIU-IND (Financial Intelligence Unit-India) |

| Liquidity Origin | Localized (Domestic Investors & FIIs) | Global (Worldwide participants) |

| Asset Definition | Equity (Stake in a body corporate) | VDA (Section 2(47A)): Code/number/token generated via cryptography, specifically excluding Indian or foreign fiat. |

The Strategic “Always-On” Reality The 24/7 nature of crypto fundamentally alters risk management by eliminating “Gap Up” or “Gap Down” risks. In traditional markets, overnight news can cause a stock to open 10% lower, bypassing stop-loss orders. In the crypto environment, market reactions are instantaneous. While this provides transparency and immediate exit opportunities, it necessitates automated monitoring. For wealth managers, the lack of a “closing bell” means risk management must be programmatic rather than manual.

2. Financial Engineering and Tail Risk: Leverage and Liquidation Dynamics

High-leverage instruments in the crypto ecosystem are both seductive and perilous. Unlike traditional margin trading, these digital tools offer extreme multiples—up to 100x or even 500x—demanding a higher level of technical competency. In this environment, the window between a successful trade and total capital depletion is razor-thin. While the system allows for extreme leverage, institutional strategists generally view 2x–3x as the only “safe” limit for non-expert participants to avoid catastrophic tail risk.

Mechanics of Leverage and the Liquidation Threshold Leverage allows a trader to control a large position with a small amount of actual capital (margin). At 50x leverage, a mere 2% market movement against the position results in a 100% loss of the initial margin.

When the margin is exhausted, the exchange performs a Liquidation:

- Isolated Margin: Limits risk to the specific amount allocated to a single trade.

- Cross Margin: Uses the entire wallet balance to maintain a position, risking the total account value.

The speed of the system is absolute. Unlike a traditional margin call, the exchange does not wait for a response; it effectively “snatches the car” (force-closes the position) the moment the threshold is breached to protect platform liquidity.

The “Double-Edged Sword” In Indian equities, volatility is capped by circuit breakers. Crypto’s standard volatility (20–30% daily moves) makes high leverage a “double-edged sword.” This environment prioritizes “forced exits” over “long-term holding,” as even a temporary spike can trigger a permanent liquidation event before the asset has a chance to recover.

3. The Indian Regulatory and Fiscal Frontier: Compliance and Taxation

The Indian landscape has shifted from the 2018 RBI ban to a “Reporting Entity” status under the Prevention of Money Laundering Act (PMLA). Navigating this frontier requires strict adherence to both fiscal obligations and anti-money laundering protocols.

The Fiscal Framework for VDAs India has established a stringent tax regime that creates significant friction for active trading:

- 30% Flat Tax + 4% Cess: All gains from VDA transfers are taxed at an effective rate of 31.2%.

- 1% TDS (Section 194S): Applied to sale considerations. For a “Specified Person” (individuals/HUF not in business or with a turnover below ₹1 Cr for business/₹50 Lakhs for profession), the threshold is ₹50,000; for all others, it is ₹10,000.

- No Loss Offsets: Losses in one VDA (e.g., Bitcoin) cannot be set off against gains in another VDA (e.g., Ethereum), nor against any other income.

- Limited Deductions: Only the “cost of acquisition” is deductible; trading fees and infrastructure costs are not.

Regulatory Oversight (PMLA) Under Section 3 of the PMLA, crypto intermediaries are “reporting entities” under FIU-IND. They must:

- Perform KYC: Mandatory identity verification.

- Maintain Records: Transaction data must be kept for 5 years.

- Report Suspicious Activity (STR): Monitoring for illicit flows or frequent high-value movements.

4. Portfolio Discipline: Mitigation of Professional Pitfalls

Sound investment philosophy is the primary defense against market volatility. Technical access to 24/7 markets often leads to emotional decision-making, such as FOMO (Fear of Missing Out) or panic selling.

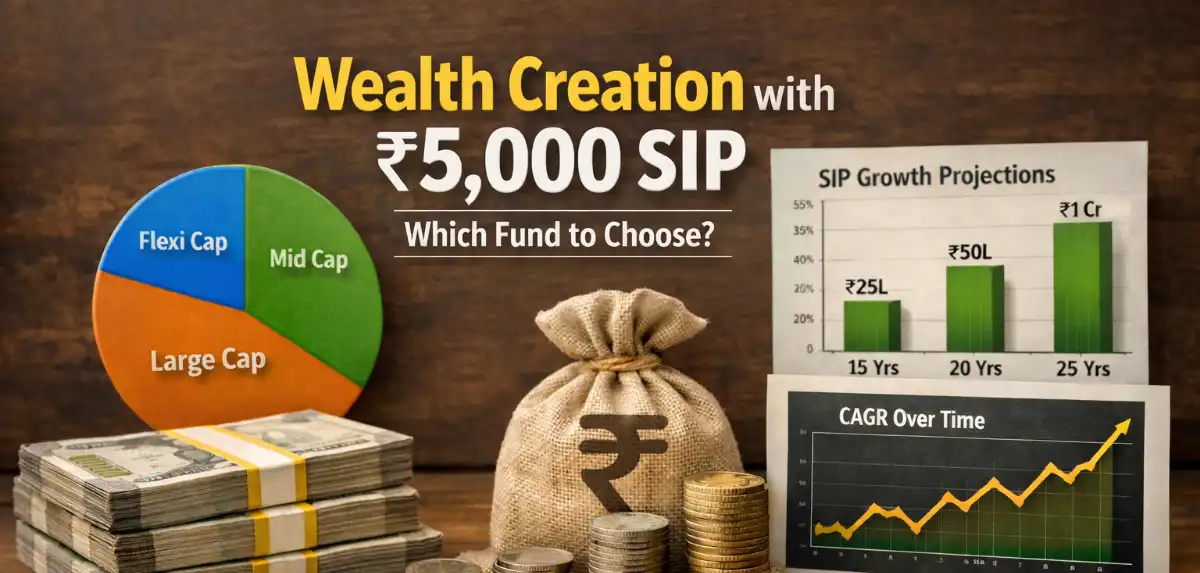

Strategic Remediation: DCA and SIP Dollar-Cost Averaging (DCA) and Systematic Investment Plans (SIP) remove the burden of market timing. By investing fixed amounts at regular intervals, investors buy more units when prices are low and fewer when they are high, lowering the average cost over time.

The Strategic Diversified Allocation (Standard ₹500 Model) A disciplined approach requires tiered allocation across risk categories:

- Blue-Chip (30%): 15% Bitcoin (BTC), 15% Ethereum (ETH) for stability.

- Layer-1/2 (20%): 10% Solana (SOL), 10% Layer-2 growth (e.g., Polygon/Arbitrum).

- High-Growth/Oracles (20%): 10% Injective (INJ), 10% Chainlink (LINK).

- Small Cap & Emerging (20%): 5% each in projects like Sei (SEI) or Celestia (TIA).

- Tactical Meme Coins (10%): 2–5% distributed among assets like DOGE, SHIB, or PEPE.

Profit-Taking Strategy for Maximum Gains

- Initial Capital Extraction: Withdraw the initial investment once the portfolio reaches a 5x–10x return.

- Tactical Trimming: Sell 20–30% of high-risk/meme coin holdings at 10x–20x.

- Stability Reinvestment: Move realized profits into stable “Blue-Chip” assets (BTC/ETH) or stablecoins to prepare for market cycles.

5. Institutional-Grade Security and Fraud Mitigation

The mantra “Not your keys, not your crypto” reflects the shift of responsibility from institution to individual. For heavy portfolios, security is as vital as strategy.

The Custody Spectrum

| Wallet Type | Security | Usability | Strategic Context |

| Exchange (Custodial) | Low | High | Best for tactical trading; risk of hack/failure. |

| Mobile (Hot) | Medium | High | Ideal for small transactions; device risk. |

| Hardware (Cold) | High | Low | Private keys offline; best for “heavy bags.” |

Threat Matrix & Institutional Risk

- Phishing: Fake platforms steal credentials. Verification of URLs is mandatory.

- Ponzi Schemes: Promises of 10–20% monthly returns. Volatility makes guaranteed profit impossible.

- Pig Butchering: Emotional manipulation for “profitable” advice. Finance must remain separate from romance.

- Giveaway Scams: Promises to “double” crypto. Real giveaways never require a deposit first.

- Rug Pulls: Developers draining liquidity. Wealth managers must check for Locked Liquidity and Smart Contract Audits before entry.

Strategic Advice: For HNW clients, the cost of a hardware wallet (~₹10,000) is negligible relative to the security gained. A multi-signature (multisig) approach should be adopted for large-scale holdings to eliminate single-point failures.

6. Summary: Risk-Assessment Framework for Wealth Managers

The wealth manager acts as the critical gatekeeper in the Indian crypto landscape, balancing explosive global liquidity against a rigorous regulatory and fiscal framework.

Top 5 Strategic Considerations:

- FIU Compliance: Only utilize exchanges registered with the Financial Intelligence Unit-India (e.g., CoinDCX, ZebPay) to mitigate legal and withdrawal risks.

- Schedule VDA Precision: Ensure all transactions are meticulously recorded for reporting under Schedule VDA of ITR-2 or ITR-3.

- Fiscal Efficiency: Minimize trade frequency to avoid the corrosive impact of the 1% TDS and the inability to offset losses between different VDA assets.

- Institutional Custody: Mandate cold storage or multisig solutions for any long-term capital allocations.

- Technical Guardrails: Advise clients against leverage exceeding 3x and proactively brief them on “Rug Pull” indicators like unlocked liquidity.

By integrating these security, strategic, and regulatory layers, advisors can provide a robust framework that captures the growth potential of digital assets while adhering to the operational realities of the Indian financial system.