Do you think investing in the stock market is only for the rich? Think again. With just ₹5,000, you can start investing in stocks and grow your money over time.

Many think stock investing is only for the wealthy. But, investing in the stock market is more accessible than you think. All you need to know is the basics and start early. Even ₹5,000 can kickstart your investment journey.

Exploring stock investing shows it’s not about having a lot of money. It’s about taking that first step towards a secure financial future.

Key Takeaways

- Investing in the stock market is accessible with a small amount like ₹5,000.

- Understanding the basics is crucial before you start investing.

- Starting early can significantly impact your investment growth.

- Stock investing is not limited to the wealthy; it’s for anyone willing to learn.

- Securing your financial future can begin with a single investment step.

Understanding the Basics of Stock Market Investing

You don’t need a lot of money to start investing. Learning the basics of stock market investing can give you confidence. It’s key for new investors to understand the stock market’s fundamental concepts.

This knowledge helps you make smart investment choices, even with a small amount like ₹5,000.

What Are Stocks and How Do They Work?

Stocks are like owning a piece of a company. When you buy a stock, you own a small part of that company’s assets and profits. The value of your stock can change based on the company’s success and market trends.

For example, investing in Tata Motors when it started in India could have made your money grow a lot. Stocks are traded on places like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) in India.

The Power of Compounding for Small Investors

Compounding is very important for small investors. It’s when your investment grows more and more over time because it earns returns on returns. For instance, if you invest ₹5,000 with an 8% annual return, it can grow a lot in 10 years.

Here’s a simple example:

| Year | Investment | Return | Total Value |

|---|---|---|---|

| 1 | ₹5,000 | 8% | ₹5,400 |

| 2 | ₹5,000 | 8% | ₹11,232 |

| 3 | ₹5,000 | 8% | ₹17,530 |

This shows how investing a small amount regularly can lead to big growth over time, thanks to compounding.

Why ₹5,000 Is Enough to Begin Your Investment Journey

Investing is not just for the rich anymore. With just ₹5,000, you can start your investment journey. Many new investors think they need a lot of money to begin. But that’s not true.

Breaking the Myth That You Need Large Capital

Starting with ₹5,000 lets you invest without risking a lot of your savings. This is great for beginners who are new to the stock market. It helps you learn and feel more confident without big financial risks.

Low-cost stock optionsare available, making it easier for small investors to enter the market.

The Advantage of Starting Small in India’s Market

India’s stock market has many chances for small investors, like low-cost stock options and diverse products. Starting small lets you use these chances while keeping your first investment small. As you get more experience and confidence, you can grow your investment.

Starting with ₹5,000 lets you begin your investment journey. You can learn from your experiences and get used to the market’s changes.

Essential Preparation Before Investing Your First ₹5,000

To get the most out of your ₹5,000, you need to prepare well. Before diving into the stock market, setting up for success is crucial.

Setting Clear Financial Goals

First, define your financial goals. Are you saving for a quick trip or a big retirement? Knowing your goals helps pick the right investment path. For long-term goals, you might take on more risk.

Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART). This clarity guides your investment strategy.

Creating an Emergency Fund First

Before investing ₹5,000, have an emergency fund ready. This fund should last 3-6 months and be easy to reach. It’s your safety net against market downturns.

With this fund, you won’t have to sell your investments at a bad time. It keeps your investments safe during market ups and downs.

Understanding Your Risk Tolerance

Knowing your risk tolerance is key for small investments. It affects your investment choices. If you’re cautious, you might choose safer options. If you’re bold, you might go for higher-risk, higher-reward investments.

Understanding your risk tolerance helps you make choices that fit your goals and comfort. This way, you invest wisely and confidently.

By taking these steps, you’re ready to make the most of your ₹5,000. This preparation will help you move through the stock market with confidence and clarity.

How First-Time Investors Can Start Stock Investing With Just ₹5,000

With just ₹5,000, you can start your stock investing journey. But, where do you begin? We’ll guide you through a few simple steps to kickstart your investment.

Opening a Demat and Trading Account

The first step is to open a Demat and a trading account. A Demat account stores your shares digitally. A trading account lets you buy and sell stocks. You’ll need to pick a broker registered with Indian stock exchanges to open these accounts.

Choosing the right broker is key. It impacts your trading experience, fees, and customer service. Look for brokers with easy-to-use platforms, good prices, and strong support.

Popular Low-Cost Brokers in India

Some top low-cost brokers in India are:

- Zerodha

- Upstox

- 5Paisa

These brokers offer low fees and modern trading platforms. Compare their services to find the best match for you.

Completing KYC Requirements for Indian Investors

To meet regulatory needs, you must complete the Know Your Customer (KYC) process. You’ll need to provide identity and address proofs, along with a photo. This step is one-time and can be done online or in-person, depending on the broker.

Keeping your KYC up-to-date is vital. It keeps your trading account compliant, prevents fraud, and secures your investments.

Best Investment Options for Beginners with ₹5,000 in India

Starting your investment journey with ₹5,000 is easier than you think. There are many beginner-friendly options. You can explore different investment paths in India’s stock market.

Direct Equity Investments

Direct equity investments mean buying shares of individual companies. This lets you own a part of the company. You might benefit from its growth. But, picking the right stocks is crucial.

Affordable Blue-Chip Stocks in India

Blue-chip stocks are from well-established, financially strong companies. In India, some affordable blue-chip stocks are great for beginners. They offer stability and potential for growth over time.

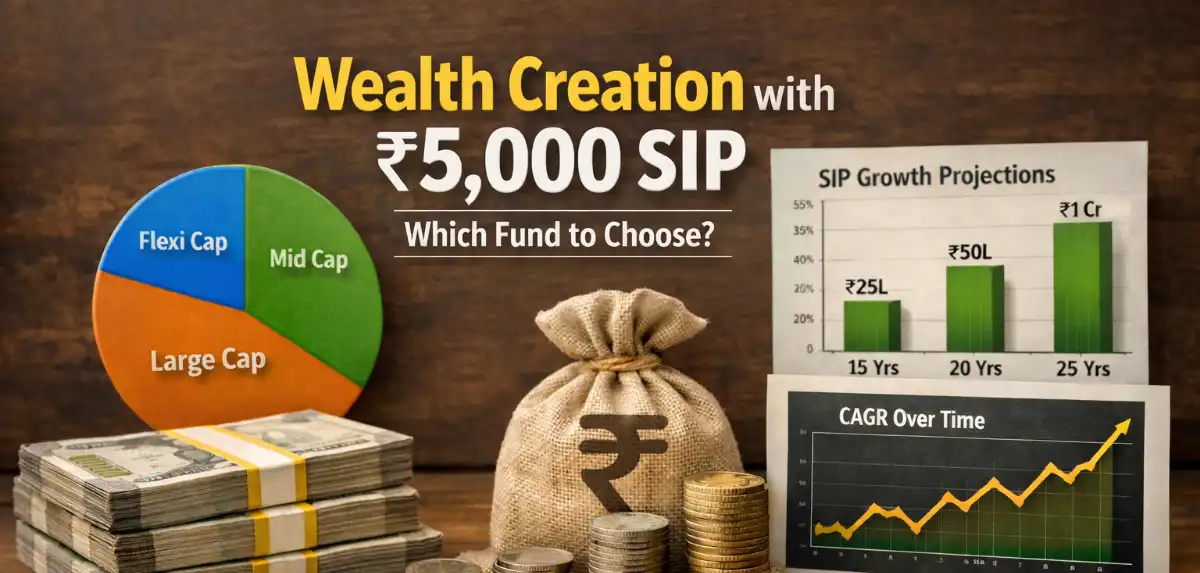

Mutual Funds and SIPs

Mutual funds combine money from many investors into a single portfolio. Systematic Investment Plans (SIPs) let you invest a fixed amount regularly. This is a disciplined way to invest.

Starting SIPs with as Little as ₹500

One great thing about SIPs is you can start with just ₹500. This makes investing accessible, even with limited capital. It helps smooth out market ups and downs over time.

Exchange-Traded Funds (ETFs)

ETFs are like mutual funds but trade like stocks. They offer diversification and can be traded all day. ETFs track specific indexes, sectors, or commodities, making them flexible.

When picking an option, think about your financial goals, risk tolerance, and how long you can invest. Diversifying your portfolio is key to managing risk. With ₹5,000, you can start building a diverse portfolio.

As a beginner, learning about investment products is important. Consider getting advice from financial advisors if needed. With the right approach and knowledge, ₹5,000 can kickstart a big investment journey.

Step-by-Step Guide to Making Your First Stock Purchase

With ₹5,000, you can start your stock investing journey. Here’s how to make your first purchase. As a beginner, understanding the steps is key.

Researching Stocks Within Your Budget

First, find low-cost stock options that fit your ₹5,000 budget. Look for companies with a solid financial history and growth potential. “The key is to start small and be consistent,” as investing is a long-term game.

Using Stock Screeners and Analysis Tools

Use stock screeners and analysis tools to find stocks. Filter by price, dividend yield, and market capitalization. These tools help narrow down your choices and make informed decisions.

Executing Your First Trade

After picking a stock, it’s time to make your first trade. Log in to your trading account, enter the stock symbol, and the quantity you want to buy. Double-check your order before confirming. As a beginner, follow beginner investing tips to avoid mistakes.

By following these steps, you can confidently make your first stock purchase. Start building your investment portfolio.

Smart Investment Strategies for Beginners with Limited Funds

Starting to invest with little money can be tough, but there are smart ways to do it. Even with just ₹5,000, we can make our money work hard. It’s all about choosing wisely and being careful with risks.

Rupee Cost Averaging Through SIPs

Rupee Cost Averaging (RCA) helps us deal with market ups and downs. By investing a set amount regularly, we spread out our costs. This method lowers the risk of losing money due to market changes.

Value Investing on a Small Budget

Value investing means picking stocks that are cheap but have a strong future. For those with little money, look for companies with a solid history, low debt, and a strong market position. Even with a small budget, we can invest in a few good stocks for the long haul.

Growth vs. Dividend Stocks for Small Portfolios

There are two main types of stocks: growth and dividend. Growth stocks grow fast, while dividend stocks give out part of their earnings. Mixing both in a small portfolio can offer growth and regular income.

Index Investing for Indian Beginners

Index investing is a simple way to invest in the market. It involves buying into a fund that mirrors a big market index, like the Nifty 50. It’s cheap, easy to start with, and helps spread out our risk without picking individual stocks.

By using these smart strategies, beginners with little money can start their investment journey. It’s all about being informed, patient, and making the most of what we have.

Managing Risks When Investing with a Small Capital

For first-time investors with ₹5,000, managing risks is key to a successful investment journey. Investing in the stock market involves risk. But, there are strategies to reduce these risks and aim for big returns.

One big challenge with a small capital is the risk of big losses. But, the right strategies can help lower this risk. We’ll look at two key strategies: diversification and setting stop-loss orders.

Diversification Strategies with Limited Funds

Diversification is a key investing principle. It means spreading your investments across different types to lower risk. Even with just ₹5,000, you can diversify your portfolio.

Mutual Funds and ETFs are great for diversifying. They combine money from many investors to invest in various stocks, bonds, or other securities. This spreads the risk.

| Investment Vehicle | Diversification Level | Minimum Investment |

|---|---|---|

| Direct Stocks | Low | ₹100 |

| Mutual Funds | High | ₹1,000 |

| ETFs | High | ₹500 |

Setting Stop-Loss Orders to Protect Your Capital

A stop-loss order tells your broker to sell a stock when it hits a certain price. This can help limit losses if the market goes against you.

For example, if you buy a stock at ₹100 and set a stop-loss at ₹90, it will sell at ₹90. This limits your loss to 10%.

By using diversification and stop-loss orders, you can manage risks with a small capital. It’s about being proactive and protecting your investments.

Understanding Taxes and Regulations for Small Investors in India

Small investors in India can start with just ₹5,000. It’s important to know about taxes and rules. Investing in stocks means dealing with tax laws and regulations.

Capital Gains Tax Implications

Investing in stocks means you’ll face capital gains tax. In India, there are two types of gains: short-term and long-term. Short-term capital gains (STCG) happen if you sell shares in less than 12 months. Long-term capital gains (LTCG) apply if you hold shares for more than 12 months.

- STCG is taxed at 15% if Securities Transaction Tax (STT) is paid.

- LTCG is tax-exempt up to ₹1 lakh, and gains over this are taxed at 10% if STT is paid.

SEBI Regulations for Retail Investors

The Securities and Exchange Board of India (SEBI) protects retail investors. SEBI sets rules for fair trading. It also requires companies to share financial info regularly.

Knowing these rules helps small investors make better choices and avoid risks.

Common Mistakes First-Time Investors Make with Small Amounts

Novice investors often start with ₹5,000 in the stock market. They might make mistakes that can be avoided. Knowing these errors helps in making the most of their investments and starting strong.

Chasing Hot Tips and Market Trends

New investors sometimes follow hot tips and trends. Relying on unverified tips can lead to bad choices. These tips often come from market ups and downs, not solid financial advice. It’s better to have a well-thought-out investment strategy that fits our financial goals.

Neglecting Research Due to Small Investment Size

Some think they don’t need to research much with a small amount like ₹5,000. But, research is key, no matter the amount. We should use all the tools at our disposal to make smart choices. This ensures our investments match our risk level and goals.

Overtrading and Eroding Capital Through Fees

Overtrading can eat away at our capital, especially with small amounts. Frequent buying and selling leads to higher costs. To avoid this, we should stick to a long-term investment approach. This means fewer trades and choosing low-cost stocks.

By knowing these common mistakes and following a disciplined strategy, we can do well in the stock market. Even with just ₹5,000 to start.

Conclusion

Starting with ₹5,000 in the stock market is a great first step for new investors. We’ve seen how even small amounts can grow with the right knowledge and strategies.

Understanding your financial goals and risk level is key. By picking the right investment, like direct equity or mutual funds, you can make the most of your budget.

It’s important to avoid common mistakes, like following hot tips without research. Being informed and disciplined helps you overcome the challenges of investing with a small amount.

Remember, every big success starts with a small step. With ₹5,000, you’re not just investing money. You’re investing in your financial future.

FAQ

Is ₹5,000 enough to start investing in the stock market?

Yes, ₹5,000 is a good starting point for investing in the stock market. We can start with affordable stocks and explore low-cost options.

What are the best investment options for beginners with ₹5,000?

For beginners, direct equity, mutual funds, SIPs, and ETFs are good options. These can help us start investing with little money.

How do I start stock investing with ₹5,000?

First, we need to open a Demat and trading account. Then, we complete KYC requirements and research affordable stocks. Using stock screeners and analysis tools helps us make informed decisions.

What are the risks associated with investing a small capital, and how can we manage them?

Risks include market volatility and limited diversification. We can manage these by diversifying and setting stop-loss orders to protect our capital.

What are the tax implications of investing ₹5,000 in the stock market?

We need to consider capital gains tax implications. Understanding SEBI regulations and tax laws helps us navigate the tax aspects of investing.

What are some common mistakes to avoid when investing with a small amount?

Common mistakes include chasing hot tips and neglecting research. We should avoid these pitfalls and adopt a well-informed investment approach.

How can we make the most of investing with ₹5,000?

By starting early and being consistent, we can maximize our returns. Adopting smart strategies like rupee cost averaging and value investing helps grow our wealth over time.

What is the importance of setting clear financial goals before investing?

Setting clear financial goals helps us determine our investment horizon and risk tolerance. This clarity enables us to make informed investment decisions.

Can we invest ₹5,000 in mutual funds or SIPs?

Yes, mutual funds and SIPs are excellent options for investing ₹5,000. They offer a diversified portfolio and the benefit of compounding, making them suitable for small investors.

2 thoughts on “How First-Time Investors Can Start Stock Investing With Just ₹5,000”