Introduction: The Market Shift No One Wants to Admit

In late 2020, a close friend—an equity-only investor—laughed when I quietly added silver to my portfolio at under $24.

“Metals are dead money,” he said.

Fast-forward to 2026—and suddenly the same people are whispering a different question:

Table of Contents

“Can silver really hit $58?”

What’s fascinating isn’t just silver’s price action—it’s why precious metals are outperforming equities without headlines, hype, or FOMO.

While stock markets wrestle with stretched valuations, geopolitical tension, currency dilution, and earnings uncertainty, gold and silver are doing what they’ve always done best—protecting real wealth quietly.

The Silent Breakdown of Equity Returns (2022–2026)

The biggest misconception today?

That equities are “still winning” because indices haven’t crashed.

But real investors don’t eat index points—they eat real returns after inflation.

Between 2022 and 2026:

- Inflation stayed structurally higher

- Earnings growth slowed

- Valuation multiples compressed

- Liquidity cycles turned hostile

Most equity investors didn’t lose money outright—but they lost purchasing power.

That’s the difference.

What changed beneath the surface?

- Central banks printed aggressively (again)

- Debt-to-GDP ratios crossed danger zones

- Real interest rates stayed unstable

- Geopolitical risk never normalized

Meanwhile, precious metals responded exactly as history predicts.

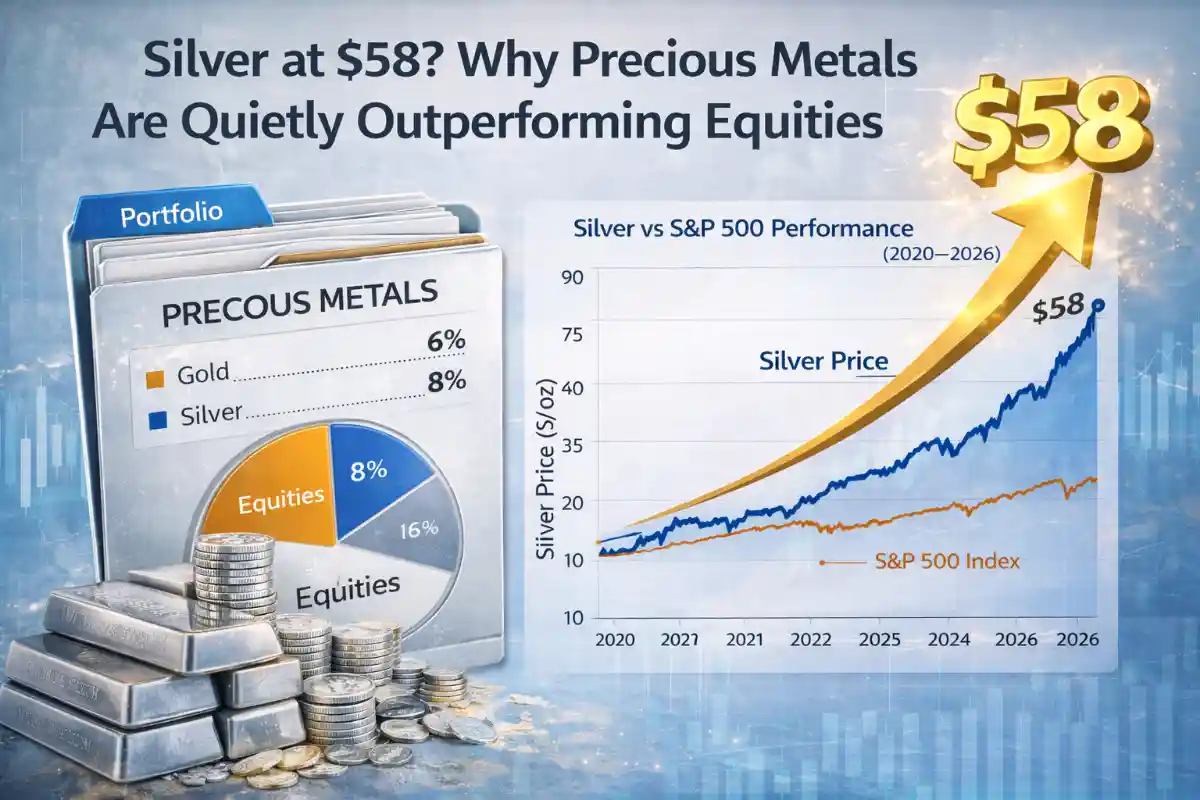

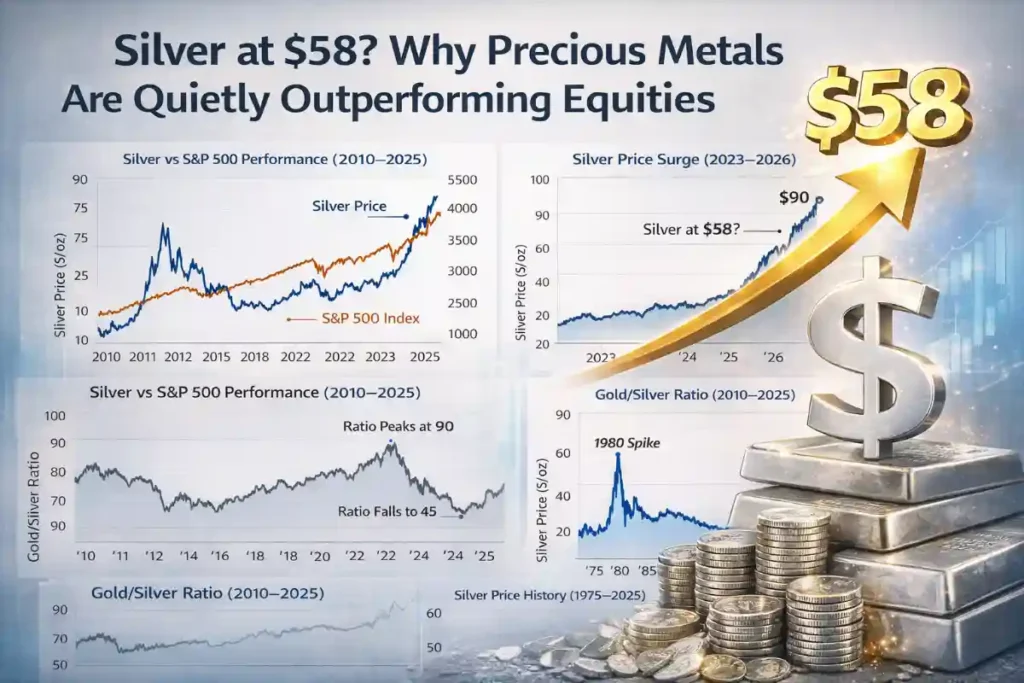

Performance Snapshot: Equities vs Precious Metals

| Asset Class | 2022–2026 CAGR | Real Return (Post-Inflation) | Volatility | 2027–2030 Outlook |

|---|---|---|---|---|

| US Equities (S&P-like) | ~6.2% | ~1.8% | High | Moderate |

| Global Equities | ~5.1% | ~0.9% | High | Uncertain |

| Gold | ~9.4% | ~5.2% | Medium | Strong |

| Silver | ~14.8% | ~9.6% | High | Very Strong |

Key Insight:

Silver’s outperformance isn’t speculation—it’s a function of macro stress + industrial demand.

Why Silver Is Not Just “Cheap Gold” Anymore

Silver used to be gold’s volatile cousin.

Today, it’s something more dangerous—to complacent portfolios.

Over 55% of silver demand in 2026 is industrial, not investment.

That matters.

Industrial Silver Demand Is Exploding

Silver is critical for:

- Solar panels

- EVs and charging infrastructure

- Semiconductors

- Medical equipment

- AI hardware manufacturing

And here’s the uncomfortable truth:

There is no scalable substitute for silver in high-efficiency energy systems.

Mining supply, meanwhile, is structurally constrained.

- Most silver is mined as a by-product

- New discoveries are declining

- ESG rules slow new projects

- Ore grades are falling

Supply vs Demand Reality Check

| Metric | 2024 | 2026 | 2030 (Projected) |

|---|---|---|---|

| Global Silver Demand (Moz) | 1,220 | 1,340 | 1,580 |

| Global Supply (Moz) | 1,010 | 1,030 | 1,080 |

| Annual Deficit | 210 | 310 | 500+ |

| Avg Silver Price ($/oz) | 26 | 38–42 | 55–60 |

Deficits don’t stay hidden forever. Prices adjust violently.

The $58 Silver Thesis (Explained Without Hype)

Let’s be clear:

$58 silver isn’t a fantasy—it’s a mean-reversion + demand-shock model.

Historically:

- Silver trades at 1/60th to 1/80th of gold

- In stress cycles, that ratio compresses

In early 2026, gold averaged ~$2,450.

Even a conservative ratio of 1:42 implies silver near $58.

Why This Cycle Is Different

- Industrial demand didn’t exist at this scale before

- Central banks are buyers again

- Retail investors are late

- ETF inventories are tightening

- Physical premiums remain elevated

Price Scenario Models

| Scenario | Gold Price | Gold-Silver Ratio | Silver Price |

|---|---|---|---|

| Conservative | $2,700 | 55 | $49 |

| Base Case | $3,000 | 48 | $62 |

| Bull Case | $3,300 | 40 | $82 |

The base case alone justifies $58.

Why Equities Are Struggling to Keep Up

Stocks aren’t collapsing—but they’re losing narrative power.

Structural Headwinds for Equities

- Elevated valuations vs earnings

- Margin pressure from wages & energy

- AI capex without immediate ROI

- Rising taxation risks

- Political interference

Even quality companies face:

- Slower multiple expansion

- Lower buyback efficiency

- Earnings volatility

Comparative Return Efficiency

| Asset | Risk-Adjusted Return (2022–26) | Liquidity Stress Resilience | Crisis Hedge |

|---|---|---|---|

| Large-Cap Stocks | Medium | Low | Weak |

| Growth Stocks | Low | Very Low | Poor |

| Gold | High | High | Excellent |

| Silver | Very High | Medium | Strong |

Silver thrives when confidence cracks—stocks need confidence to survive.

Real-Life Case Study: A Portfolio Pivot That Worked

In 2023, an Indian HNI client (mid-40s, tech background) reduced equity exposure from 78% to 52%.

The difference?

- Added silver ETFs

- Accumulated physical silver bars

- Small gold allocation

By early 2026:

- Equity returns: ~6% CAGR

- Precious metals basket: ~13% CAGR

- Volatility reduced

- Drawdowns softened

Most importantly: peace of mind returned.

Portfolio Comparison (₹1 Crore Example)

| Allocation Type | 2023 Value | 2026 Value |

|---|---|---|

| Equity-Heavy (80%) | ₹1 Cr | ₹1.19 Cr |

| Balanced + Metals | ₹1 Cr | ₹1.34 Cr |

| Metals-Enhanced | ₹1 Cr | ₹1.41 Cr |

Returns don’t lie. Allocation does.

Why Central Banks Are Quietly Supporting Metals

Between 2024 and 2026:

- Central banks added over 1,100 tonnes of gold

- Dollar reserves declined

- Currency diversification accelerated

Silver doesn’t sit on central bank balance sheets—but it benefits indirectly from monetary distrust.

When currencies weaken:

- Gold protects reserves

- Silver protects citizens

Monetary Trend Outlook

| Factor | 2026 Status | 2027–2030 Impact |

|---|---|---|

| Currency Debasement | Ongoing | Accelerating |

| Debt Monetization | High | Structural |

| Rate Volatility | Elevated | Persistent |

| Precious Metal Demand | Rising | Explosive |

Should You Invest Now—or Wait?

The most dangerous phrase in markets is:

“I’ll wait for confirmation.”

By the time silver hits headlines:

- Risk-reward compresses

- Volatility spikes

- Smart money exits gradually

Smart Allocation Strategy (2026–2030)

- 10–15% precious metals total

- 6–8% silver

- Balance via ETFs + physical

- Avoid leverage

Frequently Asked Questions

Is $58 silver realistic?

Yes—based on historical ratios, supply deficits, and industrial demand.

Is silver riskier than gold?

Yes—but with higher upside and asymmetric reward.

Should beginners invest in silver?

Only as part of a diversified portfolio, not speculation.

Physical or ETF?

Both. ETFs for liquidity, physical for insurance.

Final Thoughts: Wealth Is Preserved Quietly

Every market cycle creates blind spots.

Right now, that blind spot is precious metals quietly outperforming while no one brags about it.

Silver doesn’t trend on social media.

It doesn’t promise overnight riches.

It doesn’t beg for attention.