Are you looking for a robust investment strategy to reach your long-term financial goals? The world of financial markets is always changing. To build wealth, you need a solid plan.

We think a well-planned investment is key to financial success. The HDFC Mid-Cap Opportunities Fund is part of this plan. It offers a strategic investment in mid-cap funds, which can grow a lot.

Investing in mid-cap funds is a smart part of an investment blueprint. It balances risk and return. With HDFC’s expertise, investors can reach their financial goal setting targets.

Key Takeaways

- A well-structured investment plan is vital for long-term financial success.

- The HDFC Mid-Cap Opportunities Fund is a strategic way to invest in mid-cap funds.

- Mid-cap funds offer a balance between risk and return.

- HDFC’s investment management expertise helps achieve financial goals.

- A solid investment strategy is essential for building wealth.

Understanding the HDFC Mid-Cap Opportunities Fund

The HDFC Mid-Cap Opportunities Fund focuses on mid-cap companies’ growth. It aims to help investors grow their wealth with a diverse portfolio.

Fund Overview and Investment Philosophy

This fund invests in mid-cap companies with strong growth. It looks for companies with solid finances, good management, and a competitive edge. This strategy aims to balance risk and reward, appealing to those looking to grow their wealth over time.

Historical Performance Trajectory

The HDFC Mid-Cap Opportunities Fund has shown strong performance over the years. It has handled different market conditions well. Its ability to adapt and find new opportunities in the mid-cap sector has been key to its success.

Fund Management Team and Their Approach

The team managing the fund is full of experienced professionals. They analyze market trends, company fundamentals, and economic indicators. This helps them make smart investment choices that support the fund’s goals, boosting its wealth creation.

Blueprint for Wealth: HDFC Mid-Cap Opportunities Fund – Strategic Planning

We plan to make HDFC Mid-Cap Opportunities Fund investors richer. Our strategy includes a few key steps. These are a core investment plan, sector choices, and diversifying investments. All these aim to grow your wealth over time.

Core Investment Strategy of the Fund

The HDFC Mid-Cap Opportunities Fund looks for mid-cap companies with big growth chances. It carefully checks market trends, financial health, and management quality to pick the best companies for growth.

Sector Allocation and Diversification Approach

The fund spreads investments across many sectors to reduce risks. This way, it invests in different sectors to grab new chances and avoid big losses. This strategy keeps the fund strong in all market conditions.

Long-term Wealth Creation Framework

The HDFC Mid-Cap Opportunities Fund’s plan is to grow your wealth over time. It’s based on a careful investment strategy. This plan helps the fund stay strong through ups and downs and benefit from mid-cap companies’ growth.

| Investment Strategy | Sector Allocation | Long-term Growth |

|---|---|---|

| Focus on high growth mid-cap companies | Diversified across various sectors | Disciplined investment approach |

| Thorough analysis of market trends and financial health | Capitalizing on emerging opportunities | Riding out market fluctuations |

Why Mid-Cap Funds Are Essential for Wealth Creation

Mid-cap funds are a great choice for investors looking for a balance. They offer more growth than large-caps and are less risky than small-caps. We’ll see why they’re key for growing wealth.

Growth Potentials of Mid-Cap Companies in India

Mid-cap companies in India are growing fast. They innovate and expand their markets. These companies are in their growth phase, giving investors a chance to profit from their growth. A recent report shows mid-caps grow faster than large-caps.

“The mid-cap space is where the real growth story lies, as these companies are poised to become the large-caps of tomorrow.”

Risk-Return Profile Compared to Large and Small Caps

Mid-cap funds offer a good balance between risk and return. They are less volatile than small-caps but grow faster than large-caps. This makes them a great choice for a balanced portfolio. Here’s a comparison:

| Fund Type | Average Return | Risk Level |

|---|---|---|

| Large-Cap Funds | 8% | Low |

| Mid-Cap Funds | 12% | Moderate |

| Small-Cap Funds | 15% | High |

Mid-Cap Performance Through Market Cycles

Mid-cap funds perform well through market cycles. They bounce back quickly from downturns. Their flexibility in changing markets makes them a solid part of long-term plans. They do well when the economy is growing.

Adding mid-cap funds to a portfolio can tap into their growth while managing risk. This strategy is a key part of wealth creation tactics and financial goal setting.

Key Features That Make This Fund Stand Out

The HDFC Mid-Cap Opportunities Fund shines due to several key features. These traits not only boost its performance but also attract investors. They seek a solid investment plan.

Unique Investment Methodology

The fund uses a unique investment methodology. It looks for mid-cap companies with big growth chances. This method is based on deep research and analysis. It helps the fund grab new market trends and chances.

Expense Ratio and Fund Size Advantages

The HDFC Mid-Cap Opportunities Fund has a low expense ratio. This means less cost for investors and more returns. Its fund size is also just right. It makes managing the fund efficient and flexible.

Portfolio Turnover and Investment Discipline

The fund sticks to a strict portfolio turnover policy. This keeps investments in line with its long-term goals. It helps the fund handle market ups and downs well, leading to steady results.

The HDFC Mid-Cap Opportunities Fund is a strong choice. It combines a special investment method, a good expense ratio, and careful portfolio management. It offers a great chance to profit from mid-cap companies’ growth.

Integrating HDFC Mid-Cap Fund into Your Financial Portfolio

The HDFC Mid-Cap Opportunities Fund can add value to your financial portfolio. It balances risk and return well. When building a portfolio, it’s important to use asset allocation strategies. These should match your age and risk level.

Asset Allocation Strategies by Age and Risk Profile

Asset allocation is key in managing a portfolio. Young investors with a high risk tolerance can benefit from more mid-cap funds. This is good for long-term growth. Older investors or those with lower risk tolerance might choose a more balanced approach. They might mix mid-cap funds with stable assets.

| Age Group | Risk Profile | Suggested Allocation to Mid-Cap Funds |

|---|---|---|

| 20-30 | High | 40-60% |

| 30-50 | Moderate | 30-50% |

| 50+ | Low | 10-30% |

Complementary Funds for a Balanced Portfolio

To have a balanced portfolio, you need to add other mutual funds. Large-cap funds offer stability. Debt funds help reduce risk. Diversification is key to manage risk and boost returns.

Rebalancing Techniques for Optimal Performance

Regular rebalancing is vital to keep your portfolio in check. By reviewing and adjusting your investments, you stay on track with your goals. Rebalancing can lower risk and boost long-term performance.

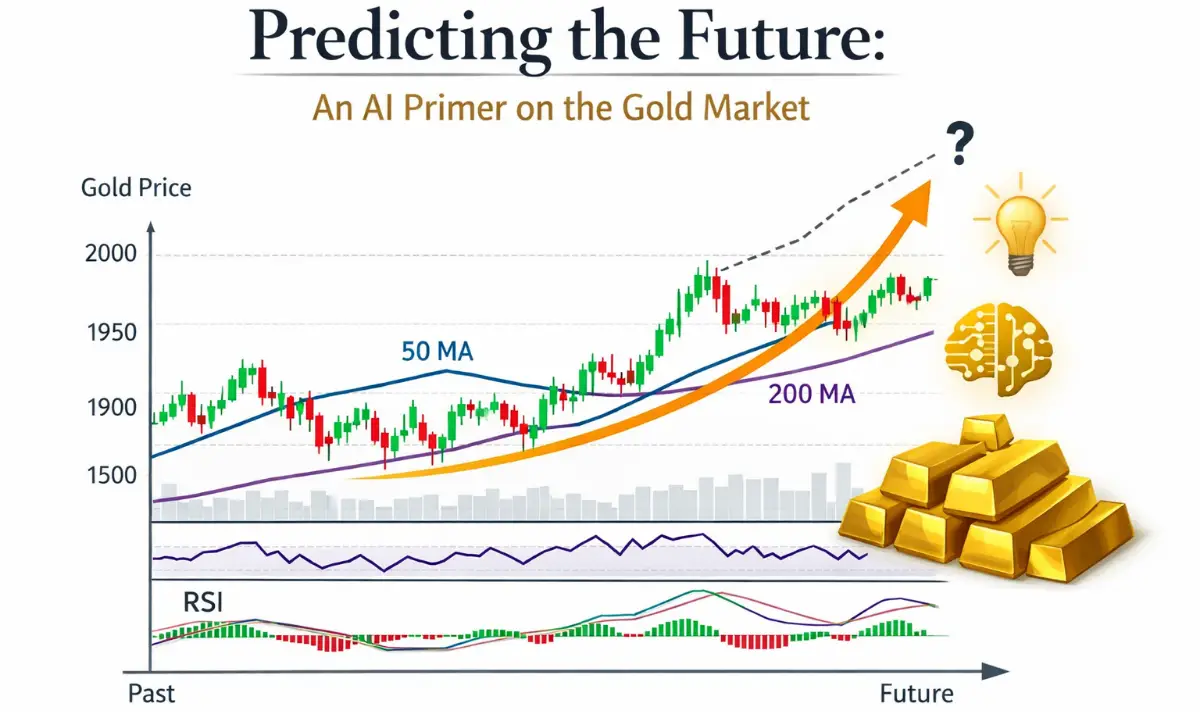

Performance Analysis: Numbers That Matter

When looking at the HDFC Mid-Cap Opportunities Fund, it’s key to check its performance numbers. These numbers show how well the fund can help grow your wealth. The fund’s success depends on its investment strategy and the skill of its manager.

Short-term vs. Long-term Returns

It’s important to know the difference between short-term and long-term gains. The HDFC Mid-Cap Opportunities Fund has shown strong results over time. Its long-term gains are impressive, showing it’s a good choice for long-term growth.

Benchmark Comparison and Alpha Generation

To really see how the fund is doing, we compare it to benchmarks. The HDFC Mid-Cap Opportunities Fund has beaten its benchmark, showing it can create value. This proves the fund’s smart strategies and the team’s investment skills.

Downside Protection During Market Corrections

Market downturns can be tough for investors. But the HDFC Mid-Cap Opportunities Fund has stood strong during these times. It offers protection against losses, helping investors keep their gains while growing their wealth.

By looking at these numbers, investors can decide if the HDFC Mid-Cap Opportunities Fund is right for them. It’s a smart choice for those looking to grow their wealth over time.

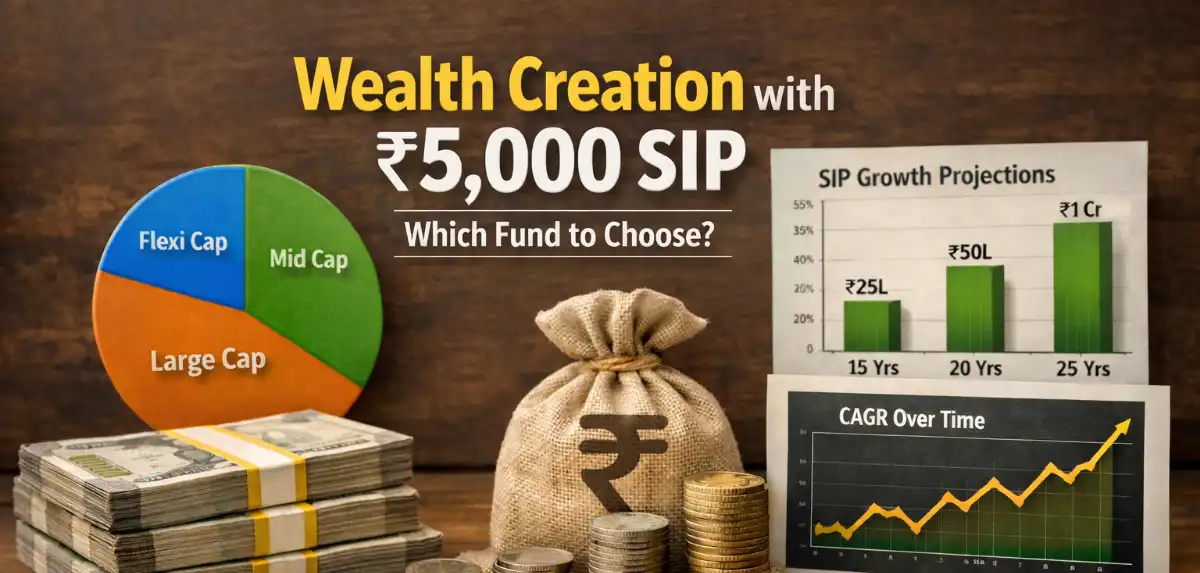

Investment Approaches: SIP vs. Lump Sum

Investors in the HDFC Mid-Cap Opportunities Fund face a choice: SIP or lump sum. Each method has its benefits and fits different needs and market conditions.

Benefits of Systematic Investment Plans

SIPs let you invest a set amount regularly. This reduces the impact of market ups and downs. It’s a smart way to invest over time, averaging out costs. SIPs are great for those with a steady income, as they can invest a fixed amount regularly.

When to Consider Lump Sum Investments

Lump sum investments mean putting a big amount into the market all at once. It’s good when the market looks like it’s going up. Those with a lot of money or a sudden windfall might choose this route.

Hybrid Approaches for Different Market Conditions

For some, mixing SIPs and lump sum investments works best. This way, you can use both strategies based on your goals and how much risk you’re willing to take.

Risk Management Strategies for Mid-Cap Investments

Mid-cap investing comes with its share of ups and downs. It’s important to use smart risk management to protect your investments. Mid-cap companies have the chance to grow a lot but can also be more affected by market changes than bigger companies.

Understanding Volatility in Mid-Cap Space

There are many reasons why mid-cap stocks can be unpredictable. These include how the market feels, economic news, and news about the company itself. Knowing what causes this unpredictability is the first step to managing the risks. Mid-cap companies are often growing fast, which can make their stock prices swing a lot.

Tactics to Mitigate Investment Risks

To lower the risks in mid-cap investments, we can use a few strategies. Spreading your investments across different areas is a good start. This way, you’re not putting all your eggs in one basket. Also, keeping your portfolio balanced by rebalancing it regularly helps keep the right mix of risk and return.

| Risk Mitigation Strategy | Description | Benefit |

|---|---|---|

| Diversification | Spread investments across sectors and asset classes | Reduces exposure to specific stock or industry risk |

| Regular Rebalancing | Periodically adjust portfolio composition | Maintains optimal risk-return profile |

| Research and Due Diligence | Thoroughly research investment opportunities | Helps in making informed investment decisions |

Setting Realistic Return Expectations

When investing in mid-cap funds, it’s key to have realistic goals. Looking at past performance can give clues, but remember, past results don’t always predict the future. It’s wise to think long-term and be ready for ups and downs.

By grasping the volatility of mid-cap investments, using strategies to reduce risks, and setting achievable goals, we can better handle the challenges of mid-cap investing.

Tax Planning and HDFC Mid-Cap Opportunities Fund

Investing in the HDFC Mid-Cap Opportunities Fund means tax planning is key. It can greatly affect your returns. Knowing the tax side of your investments helps grow your wealth.

ELSS vs. Regular Mid-Cap Fund Options

Investors can choose between Equity-Linked Savings Scheme (ELSS) and regular mid-cap funds. ELSS lets you save on taxes under Section 80C of the Income Tax Act. But, it locks your money for three years.

Tax-Efficient Withdrawal Strategies

To cut down on taxes, smart withdrawal plans are helpful. For example, taking money out after a year can get you lower tax rates. This is because it’s considered long-term capital gains.

Impact of Holding Period on Tax Liability

The time you hold your investment in the HDFC Mid-Cap Opportunities Fund matters. Long-term gains are taxed less than short-term ones. This can save you money.

| Holding Period | Tax Treatment |

|---|---|

| Less than 1 year | STCG: 15% + Surcharge + Cess |

| More than 1 year | LTCG: 10% (without indexation) on gains exceeding ₹1 lakh |

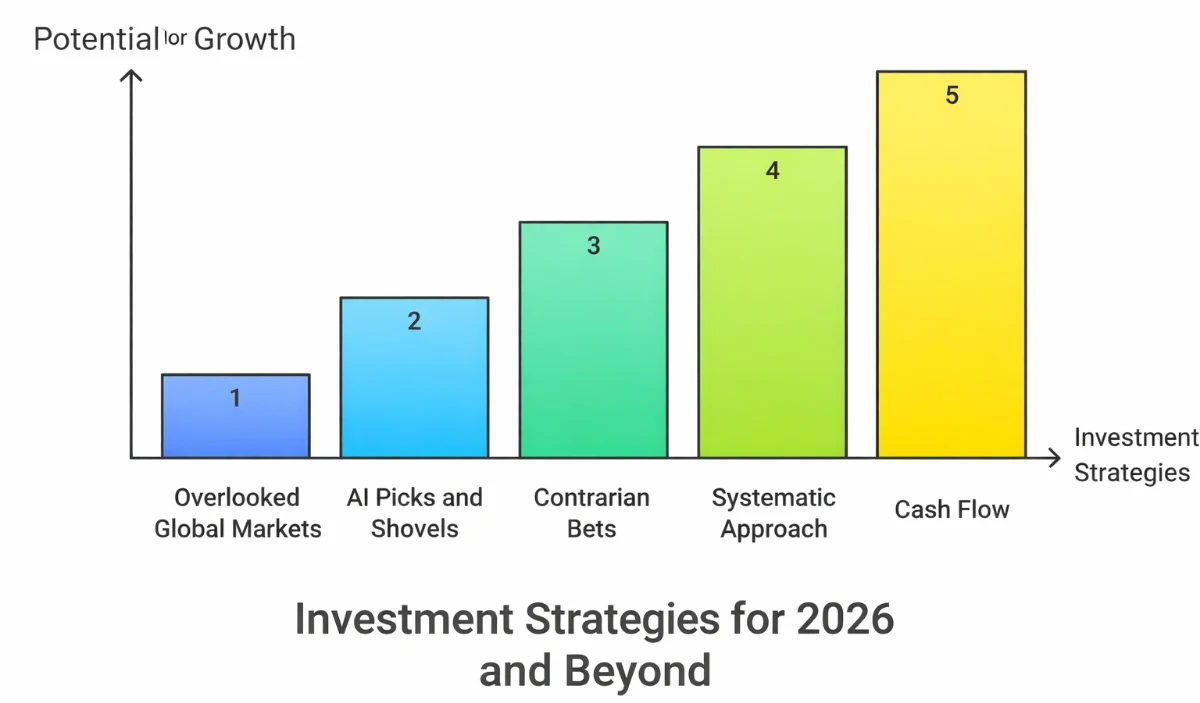

Future Outlook: Mid-Cap Investments in the Indian Economy

Looking ahead, mid-cap investments in India are set to grow a lot. The Indian economy is on the rise. This is thanks to many factors that will help mid-cap companies.

Sectoral Trends and Opportunities

Several sectors are becoming big opportunities for mid-cap investments. These include technology, healthcare, and consumer goods. Companies in these areas are innovating and growing their markets.

Regulatory Changes Affecting Mid-Cap Companies

Regulatory changes can really affect mid-cap companies. The Indian government has made it easier to do business and changed taxes. These changes are good for mid-cap companies.

Economic Factors Influencing Future Performance

Economic factors like GDP growth, inflation, and interest rates matter a lot. A stable economy helps mid-cap companies grow.

| Economic Factor | Impact on Mid-Cap Investments |

|---|---|

| GDP Growth | Positive growth supports expansion |

| Inflation Rates | Moderate inflation can boost consumer spending |

| Interest Rates | Lower rates can reduce borrowing costs |

Conclusion: Building Your Financial Future with HDFC Mid-Cap Opportunities Fund

The HDFC Mid-Cap Opportunities Fund is a great choice for building a strong financial future. It focuses on mid-cap companies in India, which can grow a lot. This fund helps you reach your long-term financial goals.

This fund has a special way of investing and managing its portfolio. It aims to create wealth by spreading investments across different areas. It’s a smart move for your investment strategy, helping you deal with market challenges and find new chances.

Adding this fund to your investment mix can make your portfolio stronger and more balanced. We suggest looking into the HDFC Mid-Cap Opportunities Fund for your wealth-building plan. It fits well with your financial goals and how much risk you’re willing to take.

FAQ

What is the HDFC Mid-Cap Opportunities Fund, and how does it fit into our overall wealth management strategy?

The HDFC Mid-Cap Opportunities Fund is a mutual fund that focuses on mid-cap companies. It offers a chance for long-term financial growth. We see it as key to our wealth strategy, balancing risk and return.

What is the investment philosophy of the HDFC Mid-Cap Opportunities Fund?

The fund looks for mid-cap companies with strong growth chances. It’s managed by a skilled team. Their strategy aims to handle different market conditions and grow investor value over time.

How do mid-cap funds perform compared to large and small-cap funds?

Mid-cap funds, like the HDFC Mid-Cap Opportunities Fund, offer a mix of growth and stability. They are more stable than small-cap funds but more volatile than large-cap funds. This makes them a good choice for those seeking a balance.

What are the benefits of investing in the HDFC Mid-Cap Opportunities Fund through a Systematic Investment Plan (SIP)?

Investing through an SIP helps us invest a fixed amount regularly. This reduces the impact of market ups and downs. It also helps us average out costs, smoothing out market swings.

How does the HDFC Mid-Cap Opportunities Fund manage risk, and what are the associated risks?

The fund uses strategies like diversification to manage risks. Mid-cap investments can be volatile. There are risks from market swings, company-specific issues, and economic downturns.

What are the tax implications of investing in the HDFC Mid-Cap Opportunities Fund, and how can we optimize our tax obligations?

Taxes depend on the fund type, holding period, and other factors. We can use tax-efficient strategies and consider ELSS or regular mid-cap funds to lower taxes.

How can we integrate the HDFC Mid-Cap Opportunities Fund into our overall financial portfolio?

We can add the HDFC Mid-Cap Opportunities Fund to our portfolio by matching it with our asset allocation and goals. We might also add other funds for balance. Periodic rebalancing ensures our portfolio stays on track.

What is the future outlook for mid-cap investments in the Indian economy?

Mid-cap companies in India have a bright future, driven by trends, regulations, and the economy. The HDFC Mid-Cap Opportunities Fund is well-equipped to seize these opportunities, helping us benefit from its market expertise.

How does the HDFC Mid-Cap Opportunities Fund compare to its benchmark indices?

We compare the fund’s performance to benchmark indices to see how it stacks up. The fund’s ability to beat the market and protect against downturns is key to its success.