The moment most people quietly give up

I still remember a conversation from early in my career.

A bright, hardworking colleague—late 20s, steady job—looked at his salary slip, sighed, and said:

“Yaar, investing is fine for people with money. What can ₹5,000 really do?”

That sentence stays with me.

Not because it’s stupid.

Because it’s honest.

Most Indians don’t fail at wealth creation because they don’t earn enough. They fail because they underestimate time, overestimate effort, and misunderstand how modern markets reward patience.

Here’s the uncomfortable truth I’ve learned after more than a decade in markets:

₹5,000 isn’t small.

Small thinking about ₹5,000 is.

Why ₹5,000 matters more today than it did 15 years ago

Let’s start with something most people miss.

The Indian investor today is playing a different game than their parents did.

What’s changed

- Market access is frictionless

SIPs, zero-brokerage platforms, instant KYC—things that once took effort now take minutes. - Information asymmetry has reduced

You no longer need insider access to understand businesses or sectors. - India’s economic growth is broader, not narrower

Earlier, wealth creation was concentrated in a few sectors. Today, multiple engines run simultaneously—tech, manufacturing, consumption, finance, renewables. - Time is still the biggest edge

And ₹5,000 invested early beats ₹50,000 invested late more often than people admit.

What I’ve noticed consistently is this:

People who start small but stay consistent end up ahead of those who wait for the “right amount.”

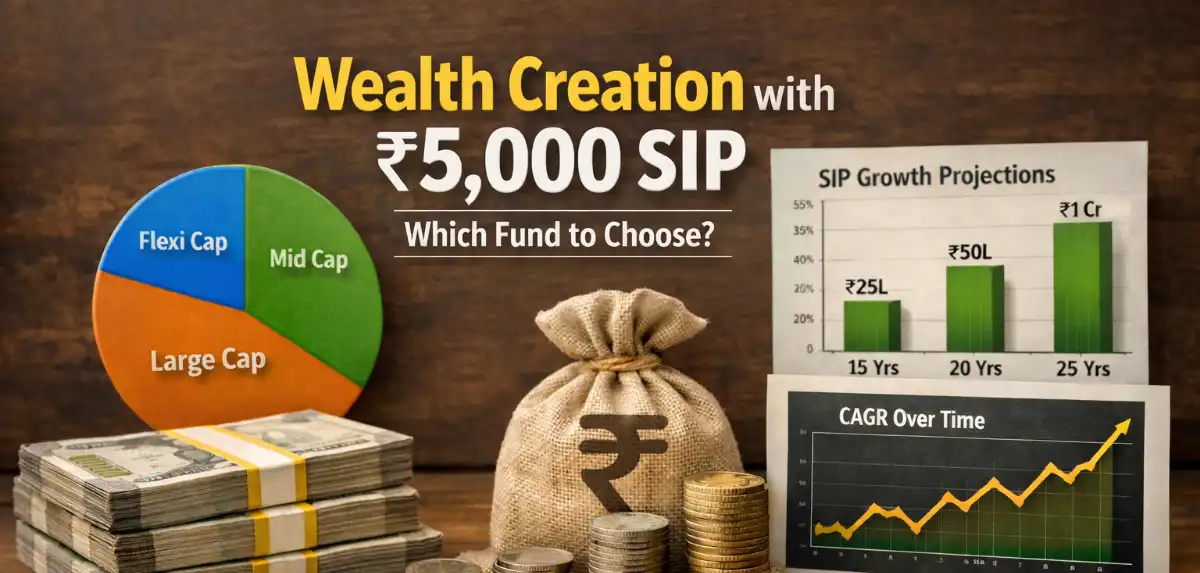

The real math behind turning ₹5,000 into crores

Let’s talk numbers—but calmly.

No viral screenshots.

No fantasy returns.

Just disciplined compounding.

The SIP reality check

Assume:

- Monthly SIP: ₹5,000

- Annual step-up: 10% (very realistic for salaried professionals)

- Time horizon: 30 years

- Long-term equity return assumption: 12%–14%

Here’s what that looks like.

Table 1: ₹5,000 SIP Wealth Potential

| Years | Avg Return | Total Invested | Approx Corpus |

|---|---|---|---|

| 20 | 12% | ₹23.5 lakh | ₹75–80 lakh |

| 25 | 13% | ₹43 lakh | ₹1.6–1.8 crore |

| 30 | 14% | ₹78 lakh | ₹3.2–3.8 crore |

Two things to notice:

- The first 15 years feel slow. Painfully slow.

- The last 10 years do the heavy lifting.

This is where most people quit—right before compounding shows its teeth.

Why most ₹5,000 SIPs fail

Here’s a hard truth from experience:

Funds don’t ruin SIPs.

Behavior does.

I’ve seen investors with excellent funds fail to build wealth because of three recurring mistakes.

1. Chasing what just worked

People enter:

- Small caps after a 3-year rally

- Thematic funds at peak narratives

- “Top performers” without understanding cycles

Markets punish recency bias brutally.

2. Stopping SIPs during fear phases

COVID.

Global rate hikes.

Election uncertainty.

Every crisis creates an opportunity—but only for those still investing when headlines scream otherwise.

3. No strategy evolution

A 22-year-old and a 42-year-old should not invest the same way.

Yet most portfolios look frozen in time.

The new-age playbook: how ₹5,000 should actually be invested

This is where experience matters.

Not theory—pattern recognition.

Stage 1: The first 7–10 years

This phase is about maximum exposure to growth, not emotional safety.

What works here:

- Flexi-cap or multi-cap funds

- Select mid-cap exposure

- One growth-oriented index allocation

Why? Because volatility early is a gift, not a threat.

You want:

- More units when markets fall

- Aggressive compounding base

I’ve seen portfolios where the first decade contributed less than 20% of capital but over 50% of eventual returns.

Stage 2: Years 10–20

Now things change.

Income improves. SIP amount grows. Responsibilities increase.

This is where strategy—not emotion—separates serious investors from casual ones.

Portfolio shifts I recommend:

- Gradual tilt toward large-cap quality

- Partial allocation to value or low-volatility strategies

- Rebalancing discipline, not fund hopping

Table 2: Portfolio Evolution by Life Stage

| Life Stage | Equity Style Focus | Risk Level | Goal |

|---|---|---|---|

| 20s | Growth / Mid / Flexi | High | Wealth creation |

| 30s | Balanced Growth | Medium-High | Scale + stability |

| 40s | Quality + Stability | Medium | Protection + growth |

| 50s+ | Conservative Equity | Low-Medium | Capital preservation |

This evolution is where most DIY investors fail—they either stay too aggressive too long, or become conservative too early.

Step-up: the silent wealth accelerator no one respects enough

If there’s one lever that quietly changes outcomes, it’s this:

SIP step-up.

Even a 10% annual increase transforms everything.

Why? Because income grows faster than expenses if you’re intentional.

Table 3: Same ₹5,000 SIP — With vs Without Step-Up (30 Years)

| Strategy | Total Invested | Final Corpus |

|---|---|---|

| Flat SIP | ₹18 lakh | ₹1.2–1.4 crore |

| 10% Step-Up | ₹78 lakh | ₹3.5+ crore |

Most people can step up.

They just don’t decide to.

Risk: the part influencers skip, but professionals obsess over

Let me be very clear.

There will be:

- 30–40% drawdowns

- Multi-year sideways markets

- Periods where FD returns look tempting

If you’re not emotionally prepared, ₹5,000 SIPs die quietly.

What I’ve learned:

- Volatility is not risk—panic is

- Time reduces risk more effectively than diversification alone

- Consistency beats intelligence in markets

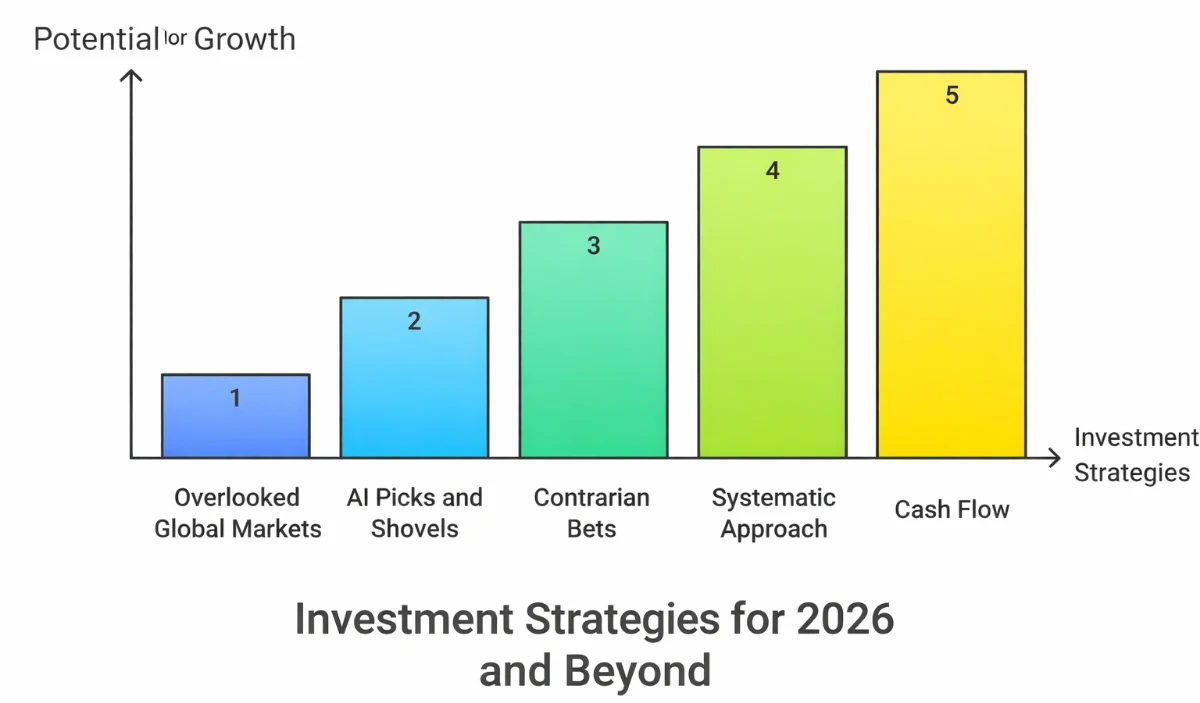

What 2026–2030 realistically looks like for long-term SIP investors

No crystal balls. Just trends.

What’s in favor:

- India’s formalization and digitization

- Manufacturing and export push

- Financialization of household savings

- Younger investor base with longer horizons

What to be cautious about:

- Global rate cycles

- Valuation excesses in pockets

- Overconfidence from recent returns

Table 4: Forward-Looking Return Expectations (Conservative)

| Asset Class | Expected CAGR (2026–2030) | Risk Level |

|---|---|---|

| Large-Cap Equity | 10–12% | Low-Medium |

| Mid/Small Cap Equity | 12–15% | Medium-High |

| Hybrid Equity | 8–10% | Medium |

| Fixed Income | 6–7% | Low |

Crores won’t come from avoiding risk.

They come from managing it intelligently over time.

FAQs

Can ₹5,000 really build crores or is this theoretical?

It’s realistic only with time, step-ups, and discipline. Without those, it won’t happen.

What if markets underperform?

Then timelines extend—not dreams die. Investing is probabilistic, not guaranteed.

Should beginners focus on one fund or many?

One or two well-chosen funds beat a cluttered portfolio early on.

Is lump-sum better than SIP?

Lump-sum works when timing is right. SIP works when life isn’t.

What’s the biggest enemy of long-term SIP success?

Stopping during fear. Nothing else comes close.

The real takeaway

After all these years, here’s what I know for sure:

Wealth isn’t built by big amounts.

It’s built by small decisions repeated when motivation is absent.

₹5,000 is not magical.

Time is.

If you treat this as a side habit, results will be average.

If you treat it as a non-negotiable system, crores stop sounding unrealistic.

Your move

Start.

Automate.

Step up.

Stay boring.

And let compounding do what it’s always done—reward patience quietly, then loudly.

If you want, next we can break this down into:

- Exact fund frameworks

- SIP mistakes by age group

- Or a realistic “₹5,000 to ₹1 crore” timeline calculator

Just say the word.

1 thought on “How ₹5,000 a Month Can Build Crores: The New-Age Investment Playbook”