1. The “Eighth Wonder”: Understanding the Secret of Wealth

Albert Einstein famously labeled compound interest the “eighth wonder of the world,” noting a simple divide: those who understand it earn it, and those who don’t, pay it. As your Wealth Strategy Coach, my first directive to you is to stop obsessing over “timing the market.” Trying to predict the absolute bottom or peak is a fool’s errand. Real wealth is built through “time in the market.”

Success is not about being lucky once; it is about staying invested long enough for the math of growth to take over.

The Power of Compounding Compounding is the process where your investment earns returns, and those returns are then reinvested to generate additional earnings of their own. Over time, this creates a snowball effect where your wealth grows exponentially, turning small regular contributions into a massive financial corpus.

While this exponential growth may feel like magic, it is governed by a rigorous mathematical blueprint that you can control.

2. The Blueprint: The Math of Compounding

To act as a Wealth Architect, you must understand the formula used to project the future value of your Systematic Investment Plan (SIP). This formula reveals the specific “levers”—amount, rate, and time—that drive your wealth.

The Formula: FV = P × [({(1 + r)^n – 1} / r) × (1 + r)]

- FV (Future Value): The total wealth accumulated at the end of your journey.

- P (Monthly Investment): The fixed amount you commit to investing regularly.

- r (Expected Rate of Return): The monthly periodic rate. To calculate this, take your annual expected return and divide by 12, then convert to a decimal (e.g., for 15%, use 0.15 / 12 = 0.0125).

- n (Number of installments): The total number of months you stay in play.

Case Study: Sneha’s 5-Year Journey

Sneha, age 21, decides to invest ₹1,000 every month. She doesn’t wait for a “better time”—she simply starts.

| Investment Detail | Value |

| Monthly Investment (P) | ₹1,000 |

| Expected Annual Return | 15% |

| Tenure (n) | 60 Months (5 Years) |

| Total Amount Invested | ₹60,000 |

| Total Investment Value (FV) | ₹89,681.69 |

The Strategy Insight: In just five years, Sneha generated a profit of ₹29,681.69. This is a nearly 50% return on the capital she deployed. By starting small and early, she has already outperformed most “market timers.”

The most efficient way to execute this mathematical growth is by putting your investments on auto-pilot.

3. SIPs: Your Financial Auto-Pilot

A Systematic Investment Plan (SIP) is your primary tool for wealth strategy. It is an “auto-pilot option” that ensures you invest a fixed amount into a mutual fund at regular intervals (usually monthly). It removes the need for manual intervention and, more importantly, the need for emotional decision-making.

The Architect’s Advantages

- Discipline: It forces you to “pay yourself first,” moving money into assets before you have the chance to spend it on depreciating lifestyle choices.

- Flexibility: You are in control. You can start, stop, or increase your investment as your income grows.

- Convenience: Once the auto-pay is set, your wealth builds in the background of your life.

The barrier to entry is non-existent. You can begin building your empire with as little as ₹100 to ₹500 per month.

By automating your strategy, you gain a secret weapon that turns market “scary” moments into wealth-building opportunities.

4. Mastering the Waves: Volatility and Rupee-Cost Averaging

Don’t let market “red” discourage you. As a coach, I want you to view a market dip as a “flash sale” on units. This is the logic of Rupee-Cost Averaging. Because you invest a fixed sum, you automatically buy more of an asset when it is cheap and less when it is expensive.

| Market Condition | Outcome |

| Market High | Higher Unit Price; Fewer units are added to your portfolio. |

| Market Low | Lower Unit Price; More units are purchased with the same ₹1,000. |

The Math in Motion: If you invest ₹1,000 when the price (NAV) is ₹20, you get 50 units. If the market “crashes” and the NAV drops to ₹10, your next ₹1,000 buys 100 units. You now have 150 units for a total cost of ₹2,000. Your average cost is ₹13.33 per unit, significantly lower than the starting price of ₹20.

The Bottom Line: By staying consistent, you lower your average purchase cost over time. This makes “timing the market” irrelevant; the volatility actually works in your favor by lowering the bar for your eventual profit.

This steady accumulation pays off most handsomely when you look at a full decade of growth.

5. The 10-Year Horizon: Small Efforts, Immense Gains

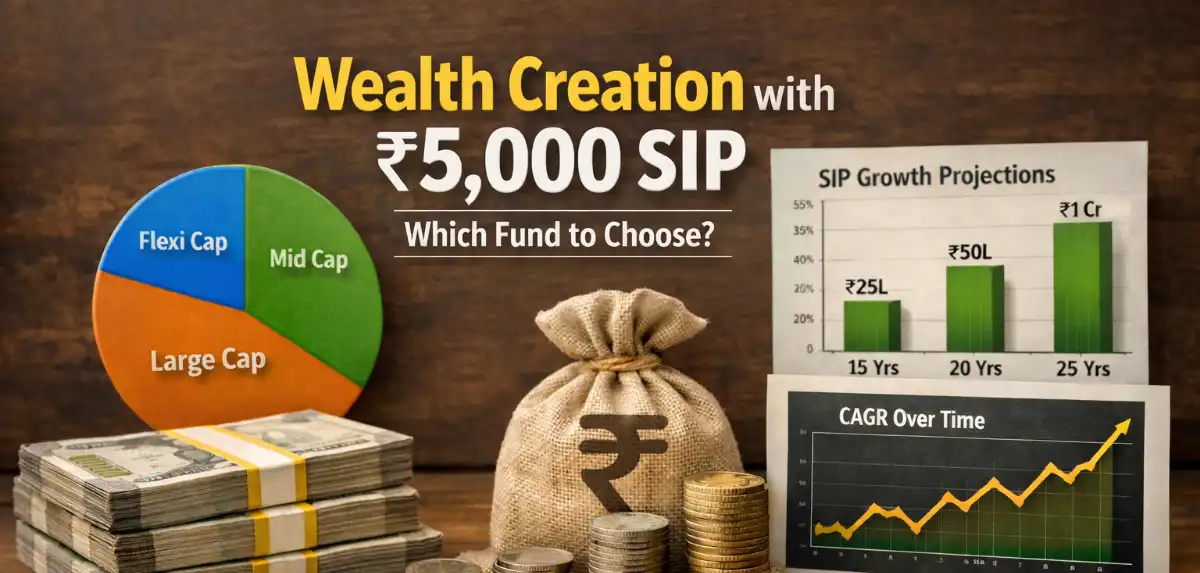

Data from early 2026 confirms that disciplined SIPs in high-growth categories have yielded spectacular results. Over the last 10 years, three primary Equity Mutual Fund categories delivered annualized returns exceeding 20%:

- Small Cap: (e.g., Quant Small Cap at 23.7%, Nippon India Small Cap at 21.7%)

- Mid Cap: (e.g., Edelweiss Mid Cap at 20.9%, Invesco India Mid Cap at 20.7%)

- ELSS (Tax Savers): (e.g., Quant ELSS Tax Saver at 20.6%)

Abdul vs. Prachi: The Power of Scale

- Abdul: Invests ₹5,000/month for 10 years (15% return) → Final Value: ~₹14.82 Lakh.

- Prachi: Invests ₹15,000/month for 10 years (17% return) → Final Value: ~₹47.34 Lakh.

The Paradox: Start at the “Top” or “Bottom”?

Many young investors wait for a market crash to start. This is a mistake. Data shows that starting at a market “Top” (Peak) often results in higher absolute wealth than starting at the “Bottom” months later. Why? Because the person who started at the peak had more time in the market and more installments working for them.

The Cost of Delay

Waiting is the most expensive thing you can do. To build a ₹3 Crore retirement fund by age 60:

- A 25-year-old needs to invest ₹2,702 per month.

- A 30-year-old needs to invest ₹5,462 per month.

A mere 5-year delay doubles your monthly cost. While the growth is vital, you must also be savvy about the “fine print” of taxes.

6. Navigating the Details: Taxes and Risk Profiles

Your net wealth is what remains after the government takes its share. According to the Tax Reckoner 2025-26, here is how your gains are treated:

| Holding Period | Tax Type | Tax Rate |

| ≤ 12 Months | Short-Term Capital Gains (STCG) | 20% |

| > 12 Months | Long-Term Capital Gains (LTCG) | 12.5%* |

*Crucial Note: The 12.5% LTCG applies only to gains above ₹1.25 Lakh in a financial year. For many young investors, this means your initial years of growth may be entirely tax-free.

Strategy Checklist: How to Choose

- Large-Cap: Choose for stability and lower volatility.

- Mid & Small-Cap: Choose for higher growth potential, provided you have a high risk appetite.

- Goal Alignment: Always match the fund to your timeline. Use equity for 10-year horizons and debt/hybrid for shorter needs.

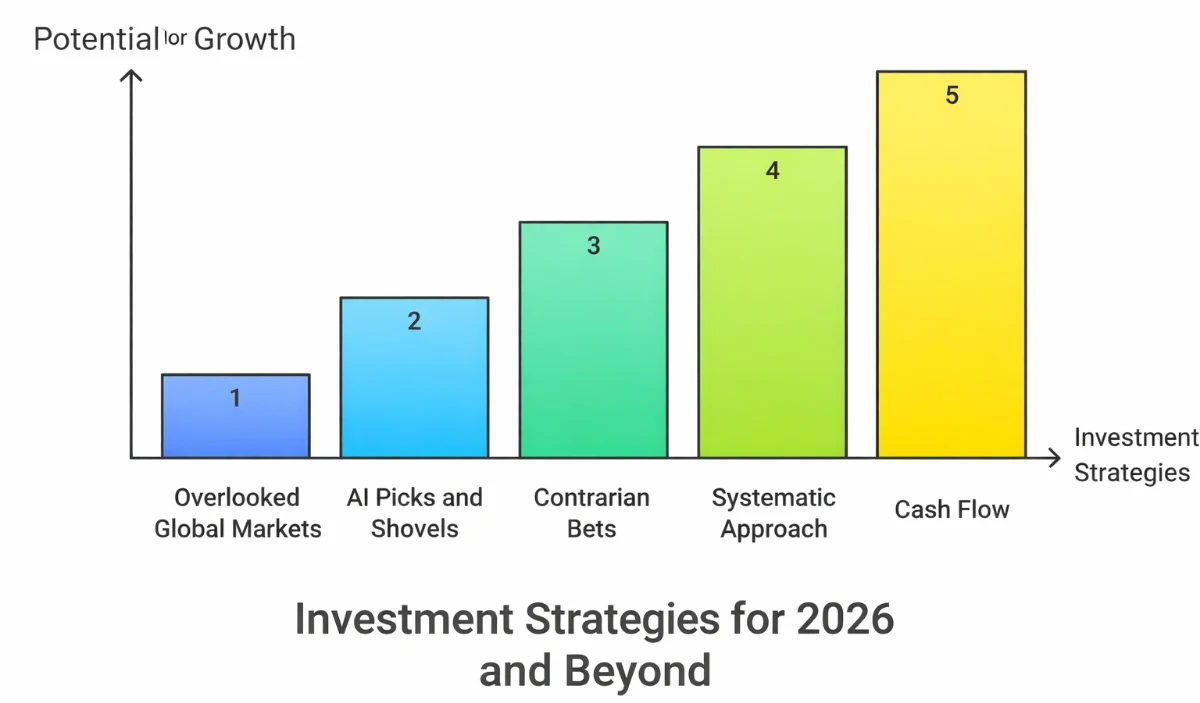

7. Conclusion: Your Future Self Will Thank You

Wealth creation is not an event; it is a marathon. To become a successful Wealth Architect, you must anchor your strategy on the three pillars of success: Start Early, Invest Regularly, and Invest for the Long Term.

Think of your financial journey like a cricket match. You don’t win by trying to hit a six on a ball that isn’t there; you win by “Staying In Play” and batting through the full quota of overs. The biggest risk you face is not a temporary market dip—it is missing out on the compounding years you will never get back.

Start your SIP today. Your future self is counting on you.