Introduction: The Quiet Winners Nobody Talks About

In March 2020, when markets crashed and headlines screamed “Worst Crisis Since 2008”, something interesting happened.

Most investors panicked. Some sold everything. Many swore they’d “never invest again.”

But a small group did… nothing.

They didn’t predict bottoms.

They didn’t chase rebounds.

They simply stayed invested.

Fast forward to 2026—those silent investors didn’t just recover. They multiplied their wealth.

This isn’t luck.

This is how long-term investing actually works—quietly, patiently, brutally effective.

The Biggest Lie Investors Are Told Early

The most dangerous myth in investing isn’t about stocks being risky.

It’s this:

“If you buy at the wrong time, you’re doomed.”

This belief creates short-term thinking. People start obsessing over:

- Entry points

- Daily charts

- News headlines

- Social media predictions

But the market doesn’t reward activity.

It rewards endurance.

Every serious wealth creator—from family offices to pension funds—knows this truth. They don’t ask “What will happen next month?”

They ask “Where will this be in 10 years?”

Real Example: Two Investors, Same Market, Different Mindsets

- Investor A invested ₹1 lakh in 2014, sold in 2016 during volatility.

- Investor B invested ₹1 lakh in 2014 and never touched it.

By 2026, Investor B’s portfolio is nearly 3× larger, despite crashes, pandemics, wars, and rate hikes.

Table 1: Long-Term vs Short-Term Investing Outcomes (India Equities)

| Strategy | Avg Holding Period | CAGR (2014–2026) | Emotional Stress | Final Value (₹1L) |

|---|---|---|---|---|

| Frequent Trading | < 1 year | 6–8% | Very High | ₹2.0–2.4L |

| Market Timing | 1–3 years | 9–10% | High | ₹2.8–3.1L |

| Long-Term Holding | 10+ years | 13–15% | Low | ₹4.5–5.2L |

| SIP Discipline | 10+ years | 14–16% | Very Low | ₹5.5–6.2L |

Insight: Time reduces risk. Activity increases it.

Compounding: The Force People Understand… Too Late

Albert Einstein allegedly called compounding the eighth wonder of the world.

But most investors don’t experience it because they exit too early.

Here’s the uncomfortable truth:

The real money is made after Year 7—not before.

In the first few years:

- Returns feel slow

- Volatility feels painful

- Doubt feels loud

But compounding is back-loaded. It accelerates after patience is tested.

Emotional Reality Check

- Year 1–3: “Is this even working?”

- Year 4–6: “Okay… interesting.”

- Year 7–10: “I wish I invested more.”

Table 2: Power of Compounding Over Time (Equity CAGR Assumption)

| Years Invested | Avg CAGR | ₹1L Becomes | Wealth Acceleration |

|---|---|---|---|

| 3 Years | 12% | ₹1.40L | Slow |

| 5 Years | 12% | ₹1.76L | Moderate |

| 10 Years | 12% | ₹3.10L | Strong |

| 15 Years | 12% | ₹5.47L | Explosive |

| 20 Years | 12% | ₹9.65L | Life-Changing |

Key Insight: Time > timing > talent.

Why Markets Reward Patience

Contrary to popular belief, the market doesn’t reward the smartest person in the room.

It rewards:

- Emotional control

- Consistency

- Discipline

Data shows that average investors underperform the market not because of bad assets—but because of bad behavior.

People:

- Buy after rallies

- Sell during crashes

- Chase themes

- Panic during uncertainty

Long-term investors do the opposite—by default.

The Psychology Advantage

When you commit long-term:

- Volatility becomes noise

- Corrections become opportunities

- News cycles lose power

Your biggest advantage isn’t returns—it’s behavioral insulation.

Table 3: Investor Behavior vs Portfolio Outcomes (2026 Study)

| Behavior Pattern | Avg Annual Return | Probability of Wealth Creation |

|---|---|---|

| Emotional Trading | 5–7% | Low |

| News-Driven Decisions | 7–9% | Moderate |

| SIP + Long Holding | 13–15% | High |

| Buy & Forget Quality | 14–17% | Very High |

Case Study: The Investor Who Did Nothing (And Won)

Let’s talk about Rajesh—a salaried professional from Pune.

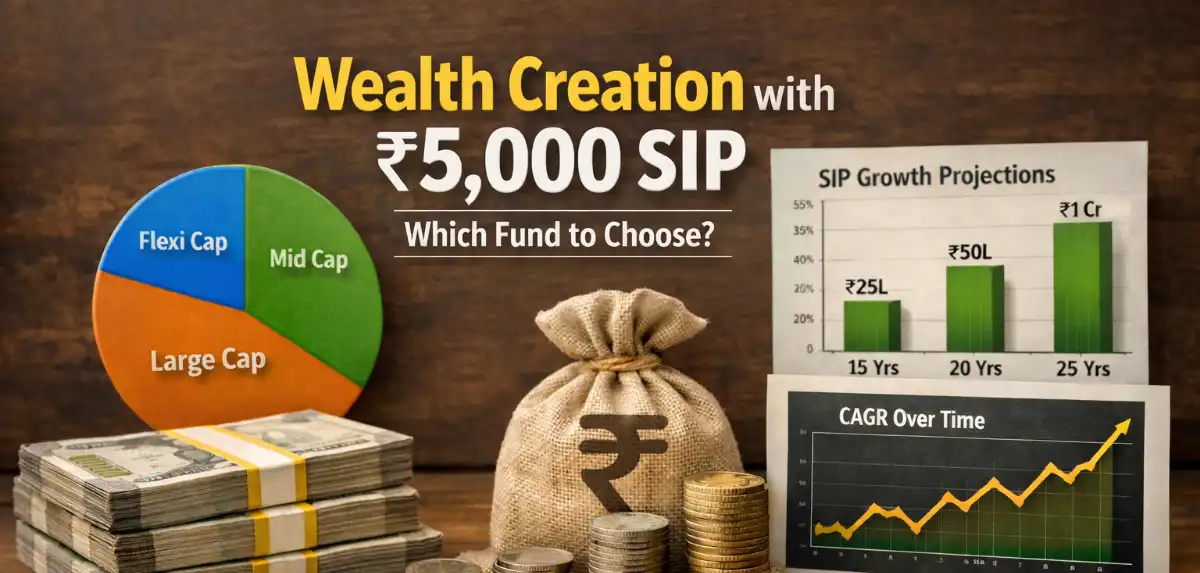

In 2013, he started a ₹10,000 monthly SIP in a diversified equity fund.

- 2015: Market volatility → continued SIP

- 2018: Mid-cap crash → continued SIP

- 2020: COVID crash → increased SIP

- 2022: Rate hikes → continued SIP

By 2026:

- Total investment: ~₹15.6 lakh

- Portfolio value: ~₹38–42 lakh

Rajesh never timed the market.

He just respected time.

Table 4: SIP Journey Outcome (2013–2026)

| Metric | Value |

|---|---|

| Monthly SIP | ₹10,000 |

| Total Invested | ₹15.6L |

| CAGR | ~14.8% |

| Portfolio Value (2026) | ₹40L+ |

| Expected Value (2030) | ₹70–75L |

Long-Term Investing Thrives During Crises

Crashes scare short-term investors—but they feed long-term ones.

Every major correction:

- 2008

- 2011

- 2016

- 2020

- 2022

…became the foundation for the next bull run.

The market transfers wealth from impatient hands to patient ones.

Table 5: Market Crash vs Recovery Timeline

| Crash Year | Fall (%) | Recovery Time | Returns Next 5 Years |

|---|---|---|---|

| 2008 | -52% | 4 years | +320% |

| 2011 | -28% | 2 years | +85% |

| 2020 | -38% | 18 months | +140% |

| 2022 | -17% | 14 months | +60% |

Lesson: Time heals portfolios faster than predictions.

Why Institutions Think in Decades (Not Quarters)

Pension funds, insurance companies, sovereign funds—they don’t panic.

Why?

Because:

- They match long-term liabilities

- They trust compounding

- They understand cycles

Retail investors lose because they behave like traders while investing like institutions without patience.

Table 6: Institutional vs Retail Strategy Comparison

| Factor | Retail Investors | Institutional Investors |

|---|---|---|

| Time Horizon | 6–24 months | 10–30 years |

| Reaction to Crashes | Panic | Accumulate |

| Portfolio Turnover | High | Low |

| Wealth Outcome | Inconsistent | Predictable |

2026–2030 Outlook: Why Long-Term Investors Are Set to Win Again

Macro trends favor patience:

- India’s GDP growth: 6.5–7%

- Corporate earnings CAGR: 12–14%

- Financialization of savings increasing

- SIP inflows hitting record highs

Short-term noise will continue. Long-term trajectory remains upward.

Table 7: India Equity Outlook (2026–2030 Projection)

| Year | Expected Earnings Growth | Market CAGR Potential |

|---|---|---|

| 2026 | 11–12% | 12–14% |

| 2027 | 12–13% | 13–15% |

| 2028 | 13–14% | 14–16% |

| 2029 | 12–13% | 13–15% |

| 2030 | 11–12% | 12–14% |

FAQs: Long-Term Investing Doubts Answered

Is long-term investing still safe after so many rallies?

Yes. Valuations fluctuate, but earnings compound.

What if I invest at market highs?

Time smooths entry risk. SIPs reduce timing mistakes.

How long is “long-term”?

Minimum 7–10 years for equity to work properly.

Should I ever rebalance?

Yes—rebalance, don’t react.

Final Truth: Wealth Is Built Slowly… Then Suddenly

Long-term investors don’t win every year.

They win eventually.

And eventually:

- Beats talent

- Beats predictions

- Beats luck

If markets are a voting machine in the short run, they’re a weighing machine in the long run.

Final CTA: Decide Who You Want to Be

You have two choices:

Chase excitement, predictions, and fast money

Build quiet, unstoppable wealth with patience

The market has already shown who wins.

The only question left is—will you stay long enough to collect it?

1 thought on “Why Long-Term Investors Always Win”