Introduction: Navigating the Noise

The current investment landscape is a dizzying mix of promise and pressure. On one hand, the artificial intelligence boom continues to accelerate, with capital expenditures projected in the trillions. On the other, high stock market valuations, particularly in the U.S., and the persistence of elevated inflation create a backdrop of strategic uncertainty. With so much hype driving a handful of mega-cap stocks, the astute investor must ask: where are the real opportunities?

Table of Contents

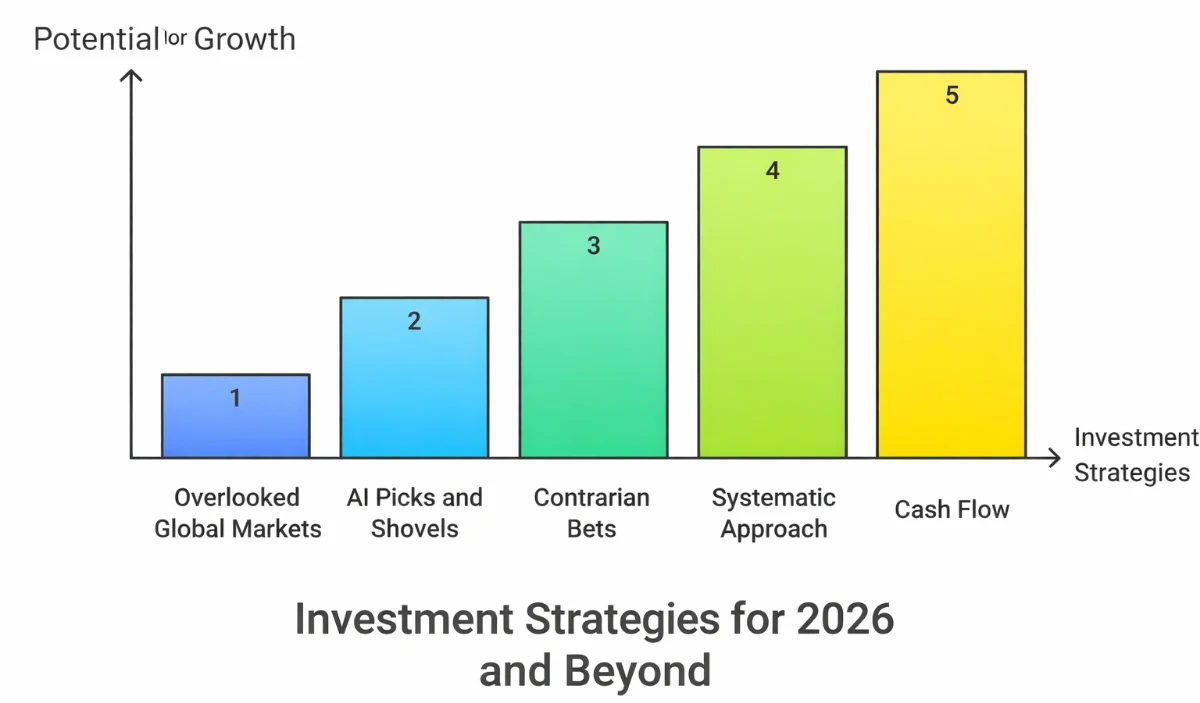

This analysis cuts through the noise. Drawing on recent market research, we will reveal five impactful, and sometimes counter-intuitive, truths that challenge conventional wisdom. These takeaways offer a practical framework for investors looking to build a resilient and forward-looking portfolio for 2026 and beyond.

1. The Smart Money May Be Looking Beyond Wall Street

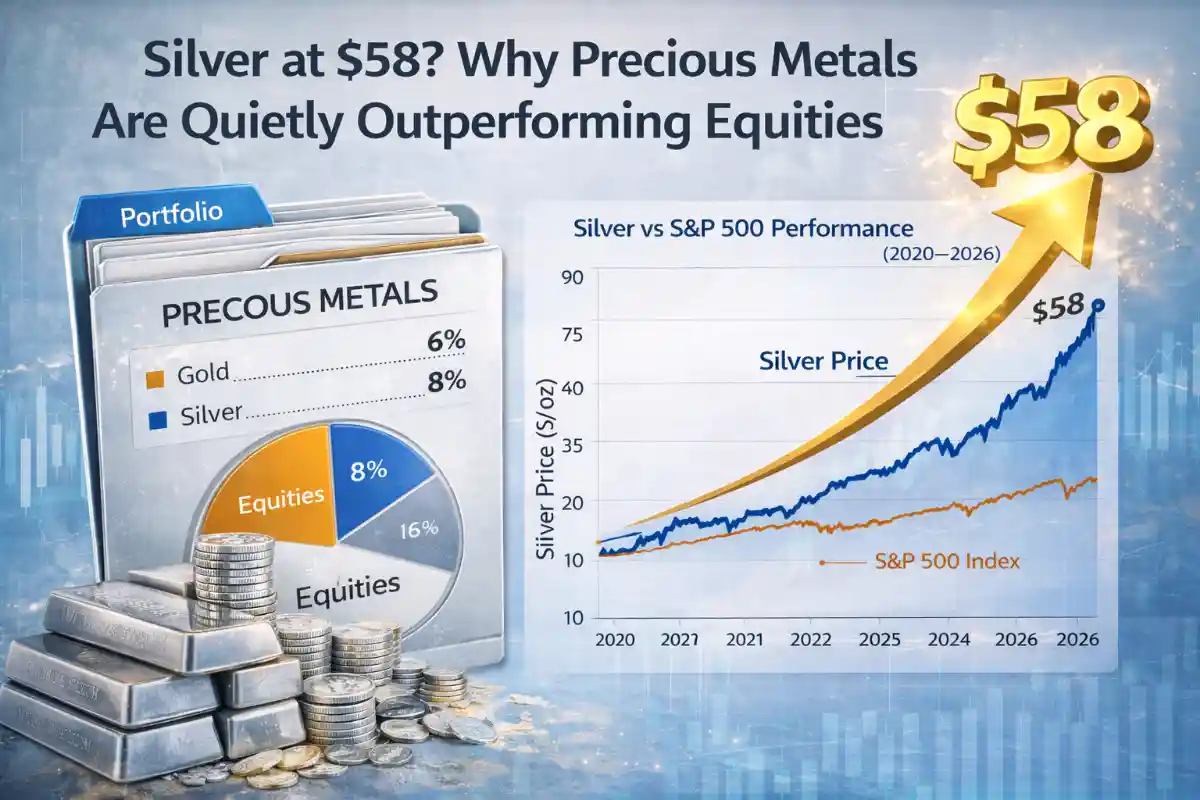

The U.S. stock market has delivered incredible returns, but its dominance may be masking a critical imbalance. The S&P 500’s cyclically adjusted P/E (CAPE) ratio is near 40, its highest level in over a decade, making domestic bargains increasingly difficult to find.

This has amplified concerns about “US exceptionalism.” The U.S. market now accounts for a staggering 66% of global equity market capitalization but contributes only 26% of global GDP. In stark contrast, emerging markets (EMs) represent approximately 40% of global GDP and 70% of global real growth, yet they comprise just 11% of the MSCI ACWI index.

The valuation gap is just as compelling. A look at the Price/Earnings-to-Growth (PEG) ratio, which measures a stock’s price relative to its growth prospects, reveals a significant disparity.

- U.S. Market PEG Ratio: 1.5x

- Emerging Markets PEG Ratio: 0.9x

This data suggests a simple but powerful truth: investors may be able to access stronger growth at a much more reasonable price by looking beyond the heavily concentrated U.S. market.

2. The Real AI Gold Rush Might Be in Selling Picks and Shovels

The scale of investment in artificial intelligence is astronomical. OpenAI alone is targeting over $1 trillion in capital expenditures to build out its data centers. While the instinct is to invest in the U.S. hyperscalers leading the charge, a more counter-intuitive—and potentially safer—strategy is to focus on the Asian “enablers” that provide the essential components for the AI revolution.

This is the classic “picks and shovels” play. Rather than betting on which company will win the AI software race, investors can profit from the entire infrastructure buildout. Two companies exemplify this strategy: Taiwan Semiconductor (TSMC) and Korea’s SK Hynix. Their strategic importance is hard to overstate.

- TSMC is responsible for fabricating 85% of global start-up semiconductor prototypes.

- SK Hynix supplies around 90% of the high-bandwidth memory for Nvidia’s latest AI GPUs.

While U.S. AI leaders trade at lofty valuations, these enablers appear more reasonably priced. TSMC’s dominant position, in particular, gives it a nearly unassailable competitive advantage.

TSMC also represents good value at 18.1x P/E as it has the strongest “moat” in the entire AI value chain. There is simply no other company that can fabricate such complicated chips, nor is there anyone trying to do so.

This strategy allows investors to benefit from the AI boom regardless of which hyperscaler ultimately comes out on top. Every dollar they spend on infrastructure flows back, in part, to the companies providing these critical components.

3. Yesterday’s Bad News Can Create Tomorrow’s Bargains

Markets are often driven by sentiment, and a string of bad news can punish a company’s stock far beyond what its fundamentals justify. This creates opportunities for contrarian investors who can look past short-term setbacks to see the potential for long-term value in a sound business.

Two recent examples highlight this principle:

- Marks & Spencer (M&S) had a difficult 2025 after a cyber-attack crippled its online sales and drove down profits.

- Novo Nordisk faced a challenging 2025, issuing four profit warnings due to supply chain issues and intense competition, which crushed investor sentiment.

The investment thesis for both is rooted in the same risk-aware logic: expectations have been reset to a very low bar. The market has already priced in the worst-case scenario, creating significant room for positive surprise. If M&S management can successfully restore online operations and capture market share, the stock offers attractive upside from its discounted valuation. Likewise, there is meaningful potential for Novo Nordisk if its new CEO can meet or beat these rebased expectations. The broader lesson is that markets can overreact, creating opportunities for patient investors to acquire shares in quality businesses at an attractive price, contingent upon management’s ability to execute a turnaround.

4. Stop Hunting for Unicorns; Use a Proven Formula Instead

The allure of finding the next “multi-bagger” can lead investors to chase hot tips and speculative stocks. A more reliable path to long-term wealth creation lies in applying a systematic framework to identify high-quality companies. Rather than searching for a secret, successful investors often use a proven formula.

One such framework for identifying long-term compounders can be summarized as follows:

Returns = Strong net earnings (PAT) growth + Good return on equity (RoE) + Good cash flows + Governance

Each component is indispensable. Strong earnings growth is the engine that drives stock returns. A high Return on Equity (RoE)—consistently above the 13-15% cost of capital typical in a market like India—is a sign of a superior business. It means management is effectively using shareholders’ capital to generate compounding profits, which can then be reinvested at that same high rate, creating a powerful engine for long-term wealth. Good cash flow is critical, providing the real money needed to fund dividends, buybacks, or further growth. Finally, strong governance ensures that management’s interests are aligned with shareholders’, a non-negotiable factor Warren Buffett captured when he said, “You cannot make a good deal with a bad person.”

Another well-known disciplined strategy is William O’Neil’s CAN SLIM system, which identifies top-performing stocks based on seven key characteristics:

- C – Current Quarterly Earnings

- A – Annual Earnings Growth

- N – New Product or Service

- S – Supply and Demand

- L – Leader or Laggard?

- I – Institutional Sponsorship

- M – Market Direction

This takeaway is empowering because it demonstrates that successful investing isn’t about luck or insider knowledge. It’s about applying a consistent, logical process to identify companies with superior fundamentals.

5. Profits Can Be an Opinion, but Cash Flow is a Fact

Expanding on the previous point, no single metric is more critical for assessing the health of a business than its cash flow. The old adage says it best: “revenue is vanity, profit is sanity and cash is reality.” While accounting profits can be manipulated, the actual cash moving in and out of a business tells the true story.

Healthy cash flows are the lifeblood of a company, funding everything from dividends and share buybacks to reinvestment for future growth. The contrast between companies that generate cash and those that don’t can be stark.

- MRF, a tire manufacturer, reinvested nearly all of its cash flows back into its business and delivered a 13X return to shareholders in a decade.

- Jain Irrigation, in contrast, pursued ambitious growth funded by debt. Its poor cash flow and mounting debt ultimately led to a collapse in shareholder value.

The key lesson here is that strong earnings growth without the backing of real cash is a major red flag. Companies that rely on debt to fuel expansion without generating sufficient cash to service that debt can easily fall into a “debt trap,” permanently destroying shareholder wealth. For any potential investment, a thorough analysis of its cash flow statement is non-negotiable.

Conclusion: A Final Thought

In a market dominated by headline-grabbing trends, the most rewarding strategies often demand a more disciplined perspective. The five truths we’ve explored are not isolated tactics; they form a cohesive investment philosophy. By applying a rigorous formula that prioritizes earnings, capital efficiency, and governance (Truth #4), and by grounding every decision in the hard reality of cash flow (Truth #5), an investor develops the very lens needed to identify true value. It is this process that uncovers the overlooked global players (Truth #1), the unglamorous but essential “enablers” of new technology (Truth #2), and the unfairly punished contrarian bets that others have written off (Truth #3).

As the rest of the market chases today’s headlines, which of these overlooked truths will you use to build tomorrow’s portfolio?

1 thought on “Beyond the Hype: 5 Surprising Investment Truths for 2026”